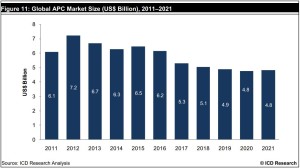

Market research company ICD predicts the global market for armored and counter IED vehicles which was valued at US$25.1 billion in 2011 will decline during the next nine years, as global operations in Afghanistan and Iraq drawing down toward the second half of the decade. As a result, the global AFV market is expected to register a negative combined annual growth rate of -0.43% during the 2011-2021 period, to reach US$24.1 billion by 2021. Nevertheless, the cumulative market value for armored vehicles and counter IED vehicles acquisition during the forecast period is estimated at US$265 billion. More information on this report.

Changing Focus of Regional Markets

Despite the high fiscal deficit of North American countries, this region is expected to account for the largest share of the armored vehicles market during the forecast period, with a share of 31.9%. Countries in Europe are also facing high fiscal debt, which will reflect in the declining market for armored vehicles during the forecast period. Europe is expected to account for 26.5% of the total armored vehicles market during this time.

Strong economic growth, territorial disputes, domestic violence and the large troop size of regional forces will create a significant demand for armored vehicles in Asia, which will account for a share of 24.1% of the total armored vehicles market during the forecast period. Soaring oil prices and high economic development in the Middle East is expected to be reflected in the demand for armored vehicles in the region, which will account for 8.8% of the total armored vehicles market during the forecast period.

Latin American countries are expected to modernize their armed forces over the forecast period; and their main modernization priority is expected to be on the air force and navy, and for other electronic and cyber warfare capabilities. As a result, the demand for armored vehicles in the region will witness a slight increase, and South America will account for just 4.7% of the global armored vehicles market during the forecast period.

The demand for armored vehicles in Africa is expected to be strong in the forecast period, driven by the discovery of new mineral and oil resources, and territorial and ethnic disputes. However, the small defense budget of countries in the region will result in a small market share of 4.1%.

Growth in the Infantry Fighting & Support Vehicles Segment

Together, APCs and IFVs are expected to account for the largest share of the total armored vehicles market across the forecast period. APCs are expected to account for 24.4% of the total market, while IFVs are expected to account for 23.2%. Increasing global troop sizes and overseas operations are expected to increase the demand for tactical trucks for operational efficiency and LMVs for deployability and mobility, with tactical trucks accounting for 18.3% and LMVs accounting for 15.4% of the total armored vehicles market during the forecast period.

Countries facing conventional threats such as territorial disputes and hostile neighbors will drive the demand for MBTs, which are expected to account for 12.7% of the total armored vehicles market. The end of the Iraq war and Afghanistan war, coupled with the integration of mine protection technology in all other classes of vehicles, will result in MRAPs contributing a share of 6% to the armored vehicles market.

Overall, the key factors behind the increasing demand for armored vehicles on a global level are overseas peacekeeping missions, the military modernization initiatives of governments around the world, and the territorial disputes and internal insurgencies faced by many countries.

Modernization Spurred by Technological Innovations

The changes in threats, terrain and tactics, further complicated by the increasing complexity of technology, has forced armed forces to modernize their fleets with platforms that cater to 21st century warfare. Therefore, modern armored vehicles must incorporate technological advancements in the fields of survivability, connectivity, mobility, maneuverability, lethality and sustainability. These capability enhancements are made possible by the advancements in processor technology, and are supplemented by the concepts of interoperability and network centric capability. Finding an optimum balance amongst protection, payload and performance, and improving the efficiency of the vehicle as a whole while simultaneously inventing ways and means to reduce operational and through-life support costs, will continue to drive research throughout the forecast period.

Considerable market growth for modular multirole vehicles

Recent changes in the global strategic security situation have resulted in a shift in the nature of warfare to increasingly asymmetric strategies. Increased urbanization and the concentration of the population along shoreline mean that future battlefields are increasingly likely to be urban littorals. This change, combined with an increase in peacekeeping and stabilization operations, requires the rapid intervention and deployment of forces, creating a demand for light- and medium-weight armored vehicles.

These technologically advanced weapons platforms must be increasingly multirole in order to meet the roles and demands of troops in various mission profiles. The integration of multirole capabilities takes time and are expensive to develop, resulting in the increased demand for commercial off-the-shelf technology. This in turn increases the demand for modularity and plug and play capability, providing the advantage of capability insertion as the technology matures and becomes available in the future.

Western Austerity Measures Encourage Consolidation

The global defense cuts, combined with a substantial increase in the cost of developing technologically superior weapons platforms, have encouraged collaboration between governments, services and industries. This has led to in-country and cross border consolidation, and an increase in joint development and procurement programs, which are expected to continue in the next ten years.

The US and Canada are the largest defense spenders in North America, and IFVs, LMVs and tactical trucks are expected to dominate the armored vehicles market in the region. The top markets in Europe for armored vehicles are expected to be Russia, the UK and France, where APCs, IFVs and LMVs are expected to account for the largest share of the market. India, China and South Korea are the leading markets for armored vehicles in Asia, as these countries face threats such as territorial disputes and domestic violence, resulting in considerable demand for MBTs.

The large troop sizes of Asian countries also create additional demand for APCs and tactical trucks through attempts to improve operational efficiency. The South Africa dominates the African armored vehicles market, with a total expected value of over US$1 billion for the forecast period. The country is expected to procure tactical trucks, APCs and MRAPs. Latin American countries, represented by Brazil and Colombia in this report, are expected to procure APCs, MBTs and tactical trucks. Middle Eastern procurement, represented by the UAE, Saudi Arabia and Israel, is expected to centre on APCs, MBTs and tactical trucks, due to threats of regional disputes and terrorism.

For more information on “The Global Armored vehicles Market 2011-2021″ (product # Defense-update DF0001SR Request for Quotation). The report is available in electronic form from ICD. Single User License costs: $4,800.-

To order this report and request more information please Contact Customer Support