Israel Ministry of Defense is slashing its planned procurement of Namer Infantry Fighting Vehicle by more than half; Under the next multi-year plan, currently formulated in Tel-Aviv, the planned allocation for the Namer procurement will be revised to no more than 170 vehicles produced through 2017. The first batch of US produced Namer hulls were delivered to Israel by the end of 2013. The seven hulls are being fitted with Israeli-made systems in Israel, prior to delivery to the operational units. Namer ICVs are currently deployed with the infantry battalions of the Golani Brigade.

According to Israeli and US sources, the US contractor for the program, General Dynamics Land Systems (GDLS), is renegotiating a 2011 contract with Israel that will likely include penalties due to budget-driven cuts in the number of heavy troop carrier kits Israel agreed to buy from the firm. Defense News reports. Industry sources expect Israel’s MoD to release its revised request for proposals by early February.

Under the eight-year deal, GDLS committed to delivering kits for some 386 vehicles through 2019 at a per-unit cost of approximately $730,000 based on full-rate production of 60 vehicles per year. The initial contract covered the production of 110 vehicles. The two-part contract stated GDLS would invest in tooling of the production line US government-owned, General Dynamics-operated Joint Systems Manufacturing Center (JSMC) in Lima, Ohio. According to the contract, the Israel MOD had an option to buy 276 additional Namer AIFVs at a firm fixed price. According to Defense News, restructuring the existing agreement would result in penalties of some $17 million, with unit costs estimated at just under $900,000 due to lost economies of scale.

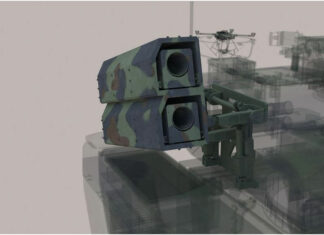

While production of Namer ICV will be curbed at about 170, Israel continues to produce Merkava Main Battle Tanks, alas at a much slower rate than before. Photo:

[/caption]An Israeli Defense Ministry spokeswoman said final approval of the IDF’s five-year plan is still pending, and therefore MoD could not comment on the prospective impact on the Namer program or its contract with GDLS.

At the height of its wartime production, the joint GD/government plant at Lima employed some 1,200 workers, churning out Abrams tanks for US and foreign customers, but with budget cutbacks and the end of most war-related work, the JSMC currently employs about 700 people.

The cut in Namer production would adversely effect JSMC, where work force has dropped in recent years from 1,100 to 700. The US Army has said it wants to stop Abrams production in 2016 and resume work in 2019 when it will start building its next-generation Abrams tank, which it is developing with General Dynamics. The production of Namer, as well as upgrade kits for M-1 Abrams tanks were essential to sustain the work force at the through 2019. Although GDLS is one of the finalists selected for the Army’s next generation Ground Combat Vehicle (GCV) program, even if the program survives the budget cuts in the coming years and if GDLS wins that contract, the GCV will not reach production in time to fill the gap.