This is a page 1 of a three page article: 1 – 2 – 3

Depleting stocks of Precision Guided Munitions (PGM) used by European Air Forces could soon trigger a renewed demand for these weapons, and heat up the debate of cost versus efficiency. Recent news reports from the U.S. that claimed precision munitions stocks of certain NATO members were depleting quickly were rebuffed by official responses from Britain and France, claiming their air forces could continue unaffected at current operational tempo. However, Pentagon sources insisted Washington was in talks with NATO allies to ensure a sufficient supply of munitions for the Libya bombing campaign.

NATO members maintaining smaller munitions stockpiles could be the most adversely affected. In a recent article published by Defense News, an unnamed British claimed Denmark did suffer precision weapons shortage, which was fulfilled by U.S. supplies. Britain and France are carrying out about half of the bombing raids in Libya with four other countries – Belgium, Canada, Denmark and Norway – conducting the rest.

While European Air Forces are relying heavily on U.S. produced laser guided bombs mostly produced by Raytheon, these models are uniquely designed for specific European built platforms and are not readily available to replenish British or French stocks from U.S. munitions reserves.

Although the United States has significant stockpiles, its munitions do not fit on the British- and French-made planes that have flown the bulk of the missions. The French Air Force uses the GBU-12, (Paveway II) GBU-22 (Paveway III) and GBU-49 Enhanced Laser Guided Bomb, (adding a GPS/INS to the basic GBU-12 kit. The French Rafale fighters used by the Air Force and Navy also carry the AASM stand-off guided munition.

The British Royal Air Force uses Paveway II and Paveway III kits with 1,000 pound warheads, carried by Tornado GR4 strike fighters. The Paveway IV loaded with 500 pound (225 kg) warheads is also carried by the Tornado and was recently cleared for the Typhoon, a step soon followed by similar clearance of the European equivalent – EGBU-16 for the German, Italian and Spanish versions of Typhoon. The European choice of enhanced LGB derive from its inherent all-weather capability, considered better adaptable to the European climate. EGBU-16 employs the 1,000 pound bomb shell converted into a guided weapon.

The Typhoon maintains an autonomously air-to-ground capability since 2008, employing the Litening III target acquisition and laser designation pod with laser guided munitions. Both types of weapons are combining GPS/INS and laser guidance enabling high precision attack under adverse weather conditions that would hinder the use of standard LGBs.

Precision has its Cost

How much European Air Forces will be asked to pay for replenishing their stock is yet unknown. Guided weapons are sold for $15,000 for the cheapest laser-guided types, to quarter of a million apiece, for the most versatile, and sophisticated models, providing stand-off, autonomous, off-boresight attack modes. The scale of the orders should also determine the cost to each customer. Maturity of the weapon have a factor on the cost per unit.

For example, a the cost of a basic JDAM kit as paid by the Pentagon was about $40,000 ten years ago. After producing almost quarter of a million weapon, Boeing could drop the cost to around $25,000, as reflected in recent orders. As weapons become more sophisticated, their cost increase – Paveway II laser guidance kits were sold for $12,000 ten years ago, but increased four to seven times higher, when served with improved seekers, electronics and optional GPS, associated with the Paveway III version. Depending on the size of the weapon – ($40,000 for a 1,000 pound and $70,000 for the 2,000 pound warhead.

like many other aerospace systems, the cost of such weapons is often increases with the weight. Additional costs are involved with the integration of GPS navigation kits. Those comprise special anti-jam receivers (SASSM) that further increase the cost of otherwise off-the-shelf capability. Overall, the cost of an EGBU-12, is around $40,000, compared to the past generation, $12,000 laser only baseline kit. In the past decade Raytheon has sold over two billion worth of laser guided bombs, by far its most active production line of laser guided bombs.

Boeing originally expected JDAM sales will add up to about two billion, but the conflicts in the Middle East and Central Asia have increased demand, actually doubling that figure. A much smaller, yet equally precise, stand-off capable weapon is the GBU-39 Small Diameter Bomb (SDB), sold for around $40,000 each (this price also reflects the cost of the associated SDB carriage system). Future acquisitions will not require these elements and further reduce the cost of SDB munition replenishment acquisitions.

More Bang – More Bucks

There are also the more expensive options – priced in the six-digit range and up – that offer advantages over the baseline precision weapons. More flexiblility, wider launch envelope, better stand-off range, ‘man in the loop’ capability, introducing manual corrections and piloting to achieve near 100% mission success.

Typically, the more expensive weapons offer an important ‘stand off’ capability – launched from 50-60 km – keeping the launching aircraft outside the range of enemy air defense missiles. Other benefits are less restrictive launch envelope and flexible mission planning. While these weapons are twice, or four times more expensive than laser guided bombs or J-class weapons, these weapons offer a ‘low cost alternative’ to much more expensive cruise missiles.

When all these factors are measured, against potential attrition of aircraft, launching of additional missions to strike targets that were not eliminated in the first run, the cost of enhanced weapons, particularly those designed for killing Surface/Air Missile sites, attacking high value targets in the first stages of the conflict, or when operating in conditions where air supermacy cannot be achieved, the higher cost of such weapons pays off in great saving in human lives, aircraft, weapons and operational expense.

Two representatives of this class are the Israeli SPICE and French AASM and, to some extent, the American Joint Stand Off Weapon JSOW-C1.

Operational with the French Air Force, and French Naval Aviation, AASM was first deployed in Afghanistan with the French Rafale in 2008. The baseline AASM kit comprises of the INS/GPS guidance system, designed for standard 250 kg (500 pounds) bombs. The AASM family will eventually include 125, 500 and 1,000 kg (250, 1000, and 2000 pounds) versions. Since the French forces have received only the initial deliveries of 3,500 weapons ordered, chances are that the used inventory could be replenished by extending current production runs. It is assumed that new weapons could be delivered at considerably lower costs than the original ones, as the manufacturer has stepped up the learning curve. Nevertheless, the cost of a basic AASM is still expected to ship at around $300,000 apiece (€200,000).

European air forces considering their future PGM roadmaps could also consider the Israeli Spice, for their stand-off, autonomous attack capability. Earlier in 2011 Greece has awarded the Israeli company Rafael Advanced Defense Systems a contract worth about €100 million to deliver 300 SPICE 1000 weapons for the Hellenic Air Force (while this deal reflects almost $480,000 unit cost, it is asusmed the cost involves spending for setup, training supporting the new weapons). SPICE is available in 2,000 and 1,000 pound versions, and will soon be offered in a 500 level. The weapon uses GPS/INS navigation with electro-optical guidance and homing techniques to achieve accurate and effective destruction of high-value targets with pinpoint accuracy and at high attack volumes. An major advantage of the Israeli weapon is its adaptability to the Tornado and F-16 platforms, employed by a number of European Air Forces and the integration with Rafael’s Reccelite tactical recce pod, enhancing the weapon’s ability to rapidly respond in engaging time critical targets from stand-off range. Reccelite is already employed by a number of NATO air forces, including the Italian, Dutch and Royal Air Force.

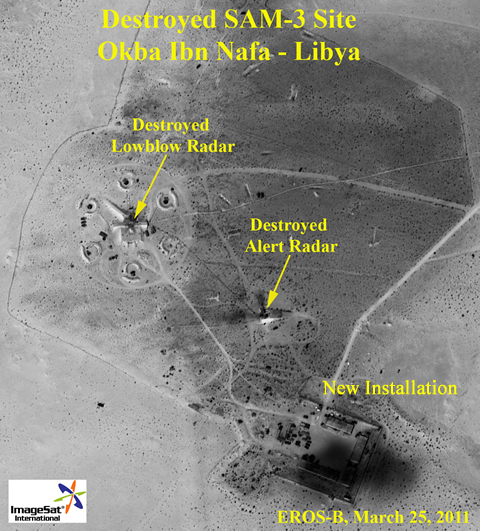

NATO strikes targeting air defense sites in Libya

NATO attacks at Misrata Airbase

Currently entering flight testing, prior to induction into service with the U.S. Navy, JSOW C-1 is an all-weather, day or night, launch-and-leave, network-enabled weapon that employs a Global Positioning System/inertial navigation system. The weapon uses an infrared seeker for terminal guidance. The test paved the way for more extensive testing, with the first free flight of the weapon expected later this year. The C-1 is a variant of the combat-proven JSOW, offering upgraded capability to strike moving maritime targets. The weapon’s Link-16 data link allows the F/A-18E/F Super Hornet aircraft to relay targeting information to the weapon. Following this initial test, the Navy is expected to follow with more extensive testing to ensure warfighter requirements are met. With the new datalink the weapon will be able to enter Navy’s secure military tactical data exchange, transferring mission data, target allocation, moving target indications and other commands. The cost of JSOW-C1 is yet unknown, but is considered to be significantly above the original JSOW, sold for around $700,000 apiece.