An unprecedented arms package agreed between Israel and Russia could open the gate for the transfer of advanced Israeli military systems and technologies to improve and upgrade Russian made military hardware. The current package worth about $50 million covers three classes of unmanned aerial systems (UAS), including training, field sustainment and technical support, to be provided by Israel Aerospace Industries (IAI). The initial deal may offer options that could double the volume of the sale up to $100 million and cover up to 100 aerial vehicles and 10 ground control systems. Initially Russia was impressed by the performance of Elbit Systems’ Hermes-450 UAS operated by Georgia, during last year’s campaign, however, it is unclear whether they opted for the IAI systems by choice, or because the transfer of Hermes 450 technology was denied by the Israelis.

The Russian Ministry of Defense delegation which visited Israel last year to discuss the deal, may have paved the way for concluding the present breakthrough. The mission was headed by the Chief of the Armament for the Russian Armed Forces, Deputy Minister of Defense, Army General Vladimir Popovkin (in picture) and Deputy Chief of Staff, Minister Alexander Gorbunov, responsible for the defense industry. This visit was viewed as an important breakthrough in the bilateral relations between the two countries, particularly relevant to Russia’s attitude toward Iran, which has become a growing customer for Russian military hardware but is also considered a potential threat to Moscow’s interests in the South. It can be assumed therefore that while the Israelis were reluctant to give the Russians access to technologies considered vital to their national security, systems of lesser concern could be discussed. While the Hermes 450 is the mainstay of Israel’s tactical UAS forces and has provided the baseline for the British Watchkeeper UAV program, the Searcher II is considered less sensitive, as it has already withdrawn from active service with the IDF and has been offered in the surplus market. The Bird-Eye 400 could also be considered as non critical technology, as it is not used by the IDF. The I-View, previously selected for Australia’s tactical UAV program (which was recently cancelled) is also looking for a new start and Russia could become important for the system’s future. IAI is marketing the I-View in several countries, in North America and Asia as well as in Israel, where another derivative of the system is competing for the future IDF brigade level UAV.

What are the Russians Expecting?

The Russians are buying three different systems under the $50 million deal, meaning they are receiving a full portfolio of ‘samples’ systems, ranging from mini-UAVs to tactical UAVs. All three are fully developed and according to IAI, two of the systems (BirdEye 400 and Searcher II) are already operational. The third – the I-View 150 is still under development. It is yet unclear if the Russians have options to add the Heron Medium Altitude Long Endurance (MALE) UAV system in the future. The Heron is currently used by a number of international operators, including India, Turkey, France and Canada. The Searcher II is also internationally operated by several clients including India, Singapore and Spain. Israel has already transferred military systems to former CIS republics like Kazakhstan, Uzbekistan and Georgia, but Russia has neither requested, nor been approved to become a customer for Israeli military hardware. The Russians interest in the Israeli unmanned systems capability evolved after their conflict with Georgia, in which the Georgians operated Elbit Systems’ Hermes UAV. Russians after-action reports clearly identified their ISR capabilities, rendered by Unmanned Aerial Systems, performing as insufficient and inferior compared to the capabilities the Georgians gained through their UAV operations.

The UAS packages includes sensitive technologies that Israel would be reluctant to disclose to the Russians, particularly mission control protocols, communications, and avionics. However, at present the Russians are interested primarily in catching up with basic requirements; technical priorities and concepts of operations (CONOPS), and transferring such know-how and skills were probably the least the Israelis could live with. Russian Deputy Defense Minister in charge of military procurement, Vladimir Popovkin confirmed the acquisition of Israeli UAVs hinting to the Russian intentions. “We will work on them (the Israeli systems) like the Chinese do” alluding to the known Chinese habit of buying ‘technology samples’ used primarily for reverse engineering. Russia’s military requirement for UAV is estimated at a minimum 100 UAVs platforms and at least ten ground control systems, providing effective battlefield reconnaissance for divisional level in support of any military conflict.

Russian UAS Technology – More Time is Needed

Anticipating these needs, the Russian Air Force and Army have already launched a number of UAV developments. Air Force Commander, Col. Gen. Alexander Zelin said last year that Russia would deploy advanced unmanned aerial vehicles with a flight range of up to 400 kilometers (250 miles) and a flight duration capability of up to 12 hours by 2011. General Staff chief Nikolai Makarov also confirmed the acquisition of Israeli UAS being considered a ‘stop gap’ solution, until home made systems will catch up with a reasonable level of this technology. The General Staff has decided that while we don’t have such drones, over the next two to three years, we will buy them from Israel” said Makarov.

According to Russian sources, the Russian built UAVs, both fixed- and rotary-wing configurations, will be supporting land, air and naval forces. While aerial platforms for these systems are within reach of Russian aerospace industries, delivering complete systems, packed with the automation, autonomy, mission planning and timely delivery of ISR products seem still years away. The two UAV systems currently operational with the Russian armed forces, which have been used in action during the summer war in Georgia and Ossetia included the piston-engine propelled PCHELA-1T and turbo-jet powered REIS-D high speed low-altitude tactical drone, both being outdated systems, developed in the 1970-1980s.

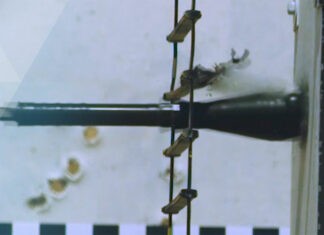

An example of Russian UAVs technology is the Tipchak system developed by the Lutch Design Bureau. According to Mr Popovkin, the drone was operational during the recent fighting with Georgia, but had demonstrated many problems, among them a distinct acoustic signature audible from long distance, which, coupled with the low ceiling, yielded high vulnerability to ground fire. The developers are currently working on a new-generation Tipchak, expected to be delivered in about three years.

The Tipchak can operate as high as 10,000 feet. The drone carries a day/night camera payload. It has an operational range of 40 km and mission endurance of about two hours. Developed to support artillery brigades with long range target acquisition, is being considered for battlefield reconnaissance as well. The Tipchak weighs 132 pounds, has a payload of 32 pounds and can stay in the air for two hours per sortie.

It is evident that the amount of the first transaction is not impressive – about $ 50 million but, according to experts, its importance is not the quantity but the very fact of Russian military customers turn to foreign suppliers and especially Israel.

Years of Cooperation Paved the Way for the Current Sale

It is not the modernization needs of the Russian military, or the export prospecst that interest the israelis, but the potential transfer of the most advanced Russian air defense system to Iran that seems to be the prime motivation behind the Israeli, so far reluctant decision to approve the UAV deal with Moscow. Israel repeatedly asked Russia to block the transfer of S-300 systems to Iran. While Moscow approved the sales package requested by Tehran, actual delivery of the system has not been cleared yet. It is highly doubtful whether the Russians will take the $50 million deal with Israel even as a free gift, instead of selling their expensive air defense missiles to the Iranians, under a multi-billion dollar arms package. It is more likely that the Israeli-Russian deal means more to both sides.

Many defense companies in Israel are involved with the upgrading of aging Russian made equipment. These include MiG-21, MiG-27 and MiG-29, Su-25 and Su-30, and a wide variety of helicopters, such as the Mi-24/35, Mi-8/17. Israeli companies are also involved in the avionics systems installed in derivatives of Russian jet trainers, namely the Alenia Aermacchi 346.

The Israelis are also heavily engaged in upgrades of Russian made armored vehicles, including T-62, T-72, T-84 and T-90 tanks, BMP armored infantry fighting vehicles, ZSu-23/4, and amphibious vehicles. So far Russia was reluctant to approve such upgrades and threatened potential customers that such unilateral actions will waive the warranty for their systems. Russia also tries to block such programs by denying critical components, such as engines and other systems, driving the upgrade’s cost to uneconomical levels.

By establishing closer links to the Russians, IAI has always managed to avoid direct confrontation with the Russians. Testimony to this approach is the tri-national deal struck with the Indian Government, where India received Israeli airborne early warning radars installed on Russian made IL-76MD transports. The Israelis are quietly marketing avionics systems for military aircraft upgrades, and even consider providing weapon systems integration on Russian produced fighters, as long as such activities are undertaken by trustworthy proxies. Another system being considered is an Israeli phased array radar technology, to be used for the improvement of a Russian fighter bid. The fact that two of the largest potential prospects for Russian military aviation, the MMRCA in India and F-X in Brazil, are open and eager to consider Israeli technology is clear to the Russians, anxious to reach parity with the most advanced systems the west can offer. IAI and Russian aerospace companies have already cooperated in the past, in the modification of the Ka-52 Alligator helicopter gunship, proposed for the Turkish helicopter gunship program, and in the upgrade of Ka-32 helicopters delivered to the South Korean Navy.

While integrating Israeli technologies in Russian systems might provide the Russians with clear benefits, particularly regarding their presently deficient technological level, the potential economical benefit for Israel is questionable, in retrospect of sensitive technological leakage to its enemies and, the risk of training the Russian engineers in advanced technologies. These are known to be masters of re-engineering, during the days of the Cold War with the west. Offering clients the possibility to upgrade Russian systems, partially with Israeli systems could even encourage some users of the Russian hardware to delay potential withdrawal from service of Russian made systems, enabling Russian defense industries to ‘catch up’ with the west, and offering better solutions in the future. As an example, Russian solutions were not even considered when India opted to replacing its Russian built SA-3 and SA-8 systems.