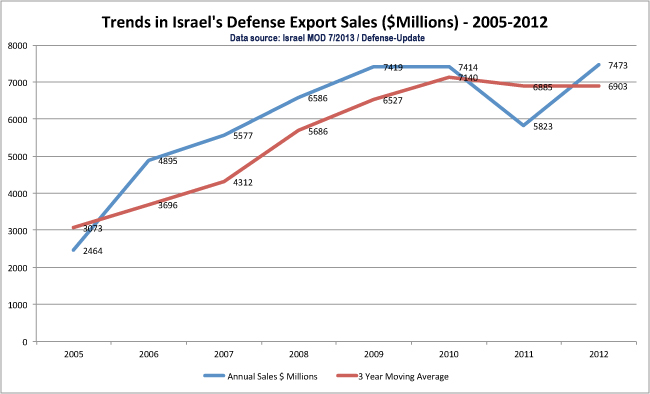

Brig. general (Ret) Shmaya Avieli, the head of Defense Exports Directorate (SIBAT) at Israel’s Ministry reported today that Israel’s defense exports in 2012 reached an all time record, totaled at US$7.473 billion. This peak came after a much lower year in 2011, as SIBAT’s reported $5.823 billion in export sales. According to Avieli, the results for 2012 were surprising, particularly due to the economical pressure and reduced demand for military hardware in recent years. (The financial reports released by the top three defense companies did not show such an increase, nor were they indicating the trough experienced in 2011.)

[nonmember]

[/nonmember]

The peak in 2012 and the low total in 2011 have similar causes – ‘mega deals’ that increase or reduce the annual total in significant numbers. In 2011 the lower level was attributed to a delay in the signature of a mega deal in Central Asia that was eventually listed in 2012, which also included another mega deal with the Italian government. When calculated by three-year floating average, the trend clearly shows a consistent growth trend from 2005 to date.

[nonmember]This article is a version of the full report, available to Members only[/nonmember]

According to Avieli the dramatic growth experienced since 2008 was attributed to large-scale acquisition of military hardware by the coalition partners, preparing their forces to meet evolving threats in Iraq and Afghanistan. “We are now entering a challenging era, where the reduction in acquisition budgets that derive from the withdrawal from these theaters and from budgetary constraints is a challenging trend” Avieli explained. He hope that the drop in 2011 will remain ‘an isolated episode’, “We are working hard to prevent repeating such episode but we can not guarantee this will be the case” Avieli said.

[nonmember]

[/nonmember]

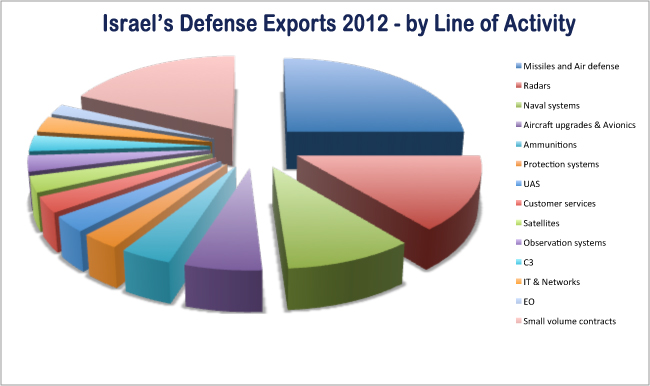

In 2012 Israel exported missile systems at a gross value worth over US$1.6 billion – the largest segment in the export pie. The main driver in this segment was Rafael Advanced Defense Systems, selling Spyder air defense systems, Spike multi-purpose guided missiles and SPICE air/ground guided weapons. Other contributors to this segment include the Israel Aerospace Industries (IAI’s) Harop. Another strong segment was the export of over a billion dollars worth of radars – attributed exclusively to IAI’s subsidiary Elta Systems. Among these radars were two Conformal Early Warning Radar (CAEW) systems sold to Italy, and significant numbers of Multi-Mission Radar derivatives, produced for a number of countries. Additional radars are also included in high profile systems such as Barak 8 and Spyder, listed for export under missile systems.

[ismember]

Naval systems were also the third strong segment, contributing more than $700 million in exports in 2012. Representative systems include RAFAEL’s remotely controlled gun systems (the ‘Typhoon’ line), various electronic systems and various naval vessels.

Aircraft upgrades and avionic systems attributed nearly half a billion US$ in sales, while ballistic and armor protection delivering nearly $300 million and unmanned aerial systems, considered a strong export driver for Israel, contributing just over $200 million. Nevertheless, unmanned aerial systems are becoming part of more comprehensive C4ISR solutions, covering communications, command and control, intelligence, surveillance and reconnaissance systems, each segment delivered about $200 million in sales. When combined together, satellite systems, command, control and communications, observation systems, optronics and related information technology projects this C4ISR segment reaches 17% of the total, reflecting a more impressive $1.27 billion level.

Customer support and after-sale services also generated over one billion dollars in sales in 2012, while small deals, each delivering less than US$10 million accounted for $1.35 billion. These deals are generally delivered by the small and medium industries segment. This segment is more exposed to the market downturn and, according to Avieli, assisting SME in developing their export reach and paving their way to export market is of a high priority for SIBAT. In recent years the share of SME in Israel’s defense export pie dropped almost 25 percent from $651-652 million level (in 2010-2011) to 500 million.

In the regional breakdown Israel’s defense exports tell another story. With Europe and the USA showing continuous year-over-year decline (excluding the 1 billion deal with Italy that increased the 2012 total into a record level). Exports to North America dropped from 2009’s $1.8 billion level to barely $1.1, reflecting the dramatic decline in demand for armored vehicle systems.

In Europe, the drop in the same period seems sharper, from $1.34 billion in 2009 to $947 million in 2011, although 2012 is marked as a very strong year, thanks to the Italian government, positioning exports to Europe at $1.640 billion.

The picture in other markets is more optimistic. In Africa, sales have passed 100 million for the second year, indicating a stronger demand and openness toward Israel in the continent, as well as heightened demand for military hardware, due to the proliferation of terror threats and the ‘fallout’ of the Libyan and Somalia campaigns.

Latin American market is also stabilizing at the $500+ million level, with exports reaching 604 million in 2012. Asia-Pacific remains the strongest export market for Israel, providing the majority of ‘Mega Deals’ that have driven the country’s exports to new heights in recent years. After missing the annual report threshold in 2011, APAC returns to the high level average of recent years, with a sales total of $3,787 million, attributed to a number of significant defense deals, mostly Government-to-Government type defense assistance packages signed with a number of countries in Central Asia, the Indian Subcontinent, Southeast Asia, the pacific Rim, Oceania. Although the official sources refrain from relating to the specific countries involved, at least some of these deals were reported by Defense-Update through 2013-2013.

During the presentation Brig. General Eitan Eshel, Head of R&D Directorate at the MOD emphasized that the sales done now are the fruits of investments in basic and specific R&D made and funded in the early 1990s. “It is important that we continue to invest in R&D, which is an investment in the future, especially when the budget cuts hit every sector”. Eshel said that despite the dramatic budget cuts announced recently, R&D budgets remained intact as not to damage past, present and future applications.

“Missile and radar systems, that attributed to nearly third of our export sales last year, were based on investments in core technologies, skills and capabilities we supported continuously over three decades.” Eshel said, commenting on the success of air/air missiles, CAEW and MMR radars and Spike systems.

[/ismember]