Eurosatory provides an excellent insight into the global armored vehicle industry, indicating the trends, technologies and evolving requirements reflected by the vehicles on display, live demos as well as the technologies shown by tens, even hundreds of suppliers and innovators.

Lighter is Better?

The most obvious trend is the shift from the heavy armored fighting vehicles (AFV) to lighter, more maneuverable yet highly protected AFVs. This trend is indicated mainly in western programs, in countries that foresee their military to be involved in contingencies overseas, mainly in lower intensity conflicts – like U.S., Canada, U.K., France, Germany, Italy, Spain, Denmark, Netherlands, Norway, Sweden and, to some extent – Brazil.

These countries have ceased producing Main Battle Tanks (MBT), and have shifted their focus to tracked AIFVs such as FRES, PUMA, CV90 and Dardo. Overall, the balance between tracked and wheeled platforms is maintained, yet the share of MBTs in these countries’ Order of Battle (ORBAT) continues to decline.

Since most of these programs are in production, teaming for new ones is key for future success of specialized original equipment manufacturer (OEMs). The US Ground Combat Vehicle (GCV), Joint Light Tactical Vehicle (JLTV) and, Marine Personnel Carrier (MPC) programs, Israeli Namer AIFV, Canadian Close Combat Vehicle (CCV) and Tactical Armored Patrol Vehicle (TAPV), the French Scorpion and VBMR, the British FRES-SV and Australian Land 121/4 programs are some of the main opportunities currently underway. More could be on the horizon as coalition forces return from Afghanistan and begin to reset and rebuild their forces and capabilities for future challenges.

More insight into each of these programs will be included in Defense-Update Show Live editions. Click here to subscribe.

Opportunities for New Designs

Eurosatory will provide ‘reality check’ for new trends. In past years (2008-2010) the coalition forces involved in the Iraq and Afghanistan conflicts demanded more protection and were willing to pay for armor. Today, defense budgets are tighter and requirements focused on short-term, with the 2014 withdrawal from Afghanistan in sight. AFVs are still making the basis for any military force. In fact, Armor and blast protection is considered ‘part of the package’, an obvious capability that must be provided for in a modern combat vehicle.

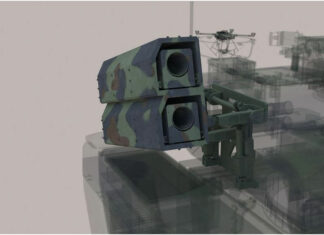

However, threatened by the cheaper, ever more capable and precise anti-tank weapons, armor protection must be increased to hitherto unaffordable weight and size. Hence, some of the solutions considered by the military include the introduction of alternative means of protection, such as soft-kill and hard-kill active protection, therefore ‘peeling off’ some of the heaviest armor layers, designed to defeat tandem high-explosive hollow-charges (Tandem HEAT) as well as high speed kinetic penetrators fired by enemy tanks. Protecting the crew and weapon systems against blast can also be achieved by introducing new materials and blast-absorbing techniques, that could further reduce weight.

More insight into each of these programs will be included in Defense-Update Show Live editions. Click here to subscribe.

MBTs Still Going Strong in Asia

Countries facing potential cross-border opponents and likely to engage in high intensity land warfare still value the use of Main Battle Tanks and therefore continue to develop, build, and upgrade MBTs – these include Russia, South Korea, India, Pakistan, Iran, Saudi-Arabia, Egypt, Israel and Turkey, each maintaining running MBT production or upgrading programs, with all countries, except Saudi-Arabia and Egypt, opting to develop indigenous designs rather than buy off-the shelf foreign tanks. Most countries retain domestic manufacturing capabilities in terms of metalwork, manufacturing and assembly of automotive systems, yet some are still lacking the knowhow and capabilities in developing and producing composites and ceramic protection modules, advanced main armament and ammunition. Other opportunities for OEM (Other Equipment Manufacturers and subcontractors) are in the field of self-protection, electronics and optronics and CBRNE (life support). Camouflage and concealment, which requires multi-disciplinary expertise in signature measurement and reduction is also a field often requiring expert advise. Introduction of health management capabilities to improve logistics could also be an opportunity for foreign suppliers improving the sustainment of such complex systems.

More insight into each of these programs will be included in Defense-Update Show Live editions. Click here to subscribe.

Second Hand Tanks are Popular

As western armies have been phasing out their advanced tanks (primarily Leopard II), a growing market for second hand tanks has also evolved, primarily for the Leopard II. Tanks withdrawn from German, Dutch and Danish armies were sold in recent years as military surplus. More tanks are likely to be offered by the Austrian and Swiss armies, as these countries are implementing planned cuts. Among the countries buying those tanks were Canada, Chile, Brazil and Singapore.

These markets open new opportunities for suppliers, offsetting for the loss of some domestic markets. Yet, for some, expanding operations overseas means higher cost of operation, at a time they are most vulnerable. One’s weakness is always the someone else’s opportunity, and, for cash rich distributors in developing markets in South Korea, India, Singapore, Turkey or Brazil – leveraging knowhow and low-volume production lines of certain parts and subsystems could offer sensible business opportunities.

More insight into each of these programs will be included in Defense-Update Show Live editions. Click here to subscribe.