Countering the UAS Threat

Tamir Eshel - 0

The ongoing wars in Eastern Europe, Caucasus, and the Middle East have emphasized drones as a new and rapidly changing tool of warfare. First manifested in the US war in Iraq and Afghanistan, the...

Iron Swords War – Air Defense Challenge

Tamir Eshel - 0

Unlike the land campaign in Gaza that involved mostly ground forces on both sides, most activities on other fronts were conducted in the aerial domain, which tasked Israeli air defense forces to spread out their assets, learn to adapt and improve under fire, and engage different threats, the new techniques, and tactics developed by the enemy. This article outlines Israel's current and evolving air and missile defense capabilities in retrospect of the recent events.

The Evolving Role of Military Unmanned Aerial Systems (UAS)

Tamir Eshel - 0

Recent combat operations have demonstrated the profound influence of unmanned aerial vehicles on recent warfare. This article highlights the new roles and utilization of UAS in ISR, logistics and attack, leveraging hybrid designs of VTOL, fixed wing, ICE and electric propulsion.

AFV Situational Awareness in the Urban Battlespace

Tamir Eshel - 0

Armored fighting vehicles face other challenges when operating in urban combat. They are exposed to snipers or anti-tank teams operating from elevated positions on rooftops or accessing underground shafts too close for the crew...

Israel’s Indoor Surveillance and Attack Drones

Tamir Eshel - 0

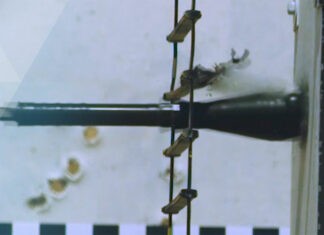

Operating drones low above ground and in complex terrain represents unique challenges, as most drone controls are limited to line of sight and uninterrupted satellite-based navigation. To endure in a GNSS-contested environment and operate indoors or underground, standard drones would not operate in such conditions. The drone platforms specially designed for subterranean or indoor environments require unique networking, sensing, navigation, and controls to enable such operations. Since these missions are complex and the drones are small, they are used in mission-specific roles such as autonomous mappers, FPV-operated lead elements, and armed effectors.