Stockholm, 14 December 2015: Sales of arms and military services by the largest arms-producing companies totalled $401 billion in 2014, according to new international arms industry data launched today by the Stockholm International Peace Research Institute (SIPRI). This represents a decrease of 1.5 per cent compared to Top 100 revenues in 2013.

Sales of arms and military services have decreased for the fourth consecutive year, according to SIPRI’s Top 100 Arms-Producing Companies report claim. However, with a reduction of 1.5 per cent in real terms between 2013 and 2014, the global decline indicated by the report remains moderate. Falls in 2014 are due to lower arms sales for companies based in North America and Western Europe, while Top 100 companies located in other regions of the world have collectively increased performance.

US and Western European arms sales declining

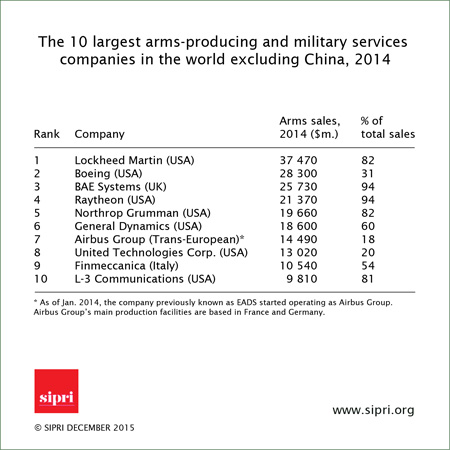

Companies based in the United States continue to dominate the Top 100, with a 54.4 per cent share of the total. US companies’ arms sales decreased by 4.1 per cent between 2013 and 2014, which is similar to the rate of decline seen in 2012–13.

One company bucking the downward trend is Lockheed Martin, which has occupied the first position in the Top 100 since 2009. Its arms sales grew by 3.9 per cent in 2014 to $37.5 billion. Lockheed Martin’s lead over the second ranked company Boeing, which had total arms sales of $28.3 billion, increased by $4.4 billion in 2014.

“With the acquisition of helicopter manufacturer Sikorsky Aircraft Corp. in 2015, the gap between Lockheed Martin and other companies ranked in the Top 10 will widen even further next year,” says Aude Fleurant, Director of SIPRI’s Arms and Military Expenditure Programme.

Western European companies’ arms sales decreased by 7.4 per cent in 2014. Only German (+9.4 per cent) and Swiss (+11.2 per cent) companies show overall growth in their arms sales in real terms. The rise in German arms sales was due to a significant growth in turnover for German shipbuilder ThyssenKrupp (+29.5 per cent), while Switzerland’s Pilatus Aircraft benefited from growing demand for its trainer aircraft, boosting Swiss sales. The companies representing the seven remaining Western European countries in the Top 100 all show an overall decline in their sales.