The Japanese defense budget is the fifth-largest in the world. Tokyo is rated among the top military spenders in Asia, along with China and India. Japan’s defense spending recorded a CAGR of 10.04% in the years 2007-2011. Japan has capped its defense budget at 1% of GDP, and is expected to continue to do so over the forecast period. The Japanese MoD spends the majority of its defense budget on revenue expenditure, which includes the salaries of personnel and maintenance of infrastructure. In terms of the armed forces, the Japanese army receives 37% of the budget, while the navy and air force receive respective shares of 23% and 24%. The Japanese defense budget is primarily driven by the perceived threat from North Korea’s missile tests and the security of sea trade routes, as the country imports the majority of its minerals and food from foreign countries.

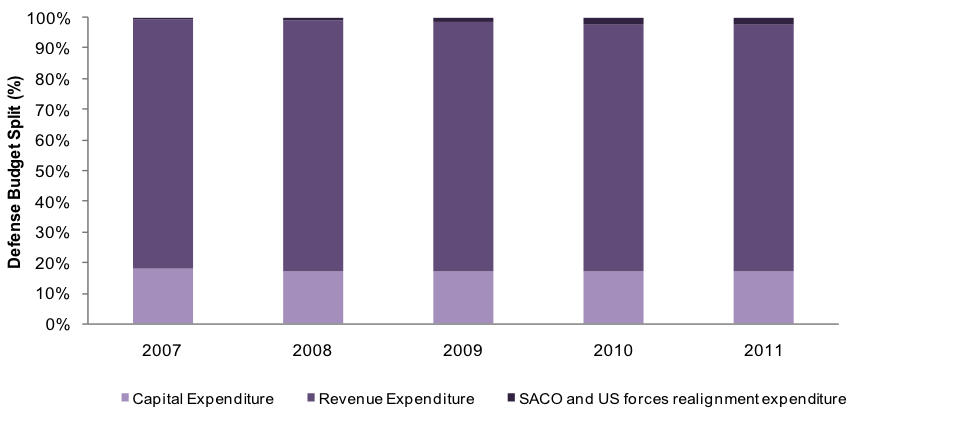

During the review period (2007-2011) an average of 81.2% of the defense budget was spent on the revenue expenses of the armed forces, which includes the salaries of armed personnel, food expenses, facility improvements and maintenance. However, over the forecast period this is expected to decline to 80.4%, as the government is projected to increase its expenditure on the realignment of Special Action Committee on Okinawa (SACO) and US forces (reference see graph).

The Japanese government’s policy to ban arms exports to other countries makes it difficult for defense companies in Japan to maintain profitability. Since 2003, 20 companies have discontinued their participation in the fighter jet manufacturing business. Furthermore, as the Japanese government makes a minimal amount of procurements domestic companies may diversify from the defense industry and enter other civilian industries.

As the government has a defense procurement policy that gives priority to indigenously manufactured goods, the establishment of a subsidiary in Japan can provide an opportunity for defense companies to supply to the Japanese MoD.

The Japanese defense investment policy insists on the government’s prior approval for investment in the defense industry. If the foreign company fails to notify the government about the investment, this may be considered to be a criminal offence and can lead to imprisonment of up to three years and/or a fine of three times the investment or YEN1 million (US$0.01 million), whichever is the larger amount.

Japan has a well-developed domestic industry, which is supported by government procurement. The domestic defense industry also procures production licenses of technology that is unavailable domestically, in order to supply the Japanese MoD with the most advanced equipment available. Japanese defense imports are expected to increase over the forecast period, partly due to government plans to procure fighter aircraft.

About ICD Research

The Country Report: “The Japanese Defense Industry – Market Opportunities and Entry Strategies, Analyses and Forecasts to 2016″ released in February 2012 is published by ICD.

To order this report please fill the form below or contact us directly at Tel: +972 54-450-8028

[box type=”download” style=”rounded” border=”full”]Order this report

ICD Research is a full-service global market research agency and premium business information brand specializing in industry analysis in a wide set of B2B and B2C markets. ICD Research has access to over 400 in-house analysts and journalists and a global media presence in over 30 professional markets enabling us to conduct unique and insightful research via our trusted business communities. Through its unique B2B and B2C research panels and access to key industry bodies, ICD Research delivers insightful and actionable analysis. The ICD Research survey capabilities grant readers access to the opinions and strategies of key business decision makers, industry experts and competitors as well as examining their actions surrounding business priorities.