Market Research and Other Other Regional Defense Updates:

Afghanistan | Australia | Brunei | Bangladesh | China | India | Indonesia | Japan | Malaysia | Myanmar |

North Korea | Pakistan | Philippines | Singapore | South Korea | Sri-Lanka | Taiwan | Thailand | Vietnam.

- UK Military Tests Radio Frequency Directed Energy Weapon System for Anti-Drone Defense Dec 23, 2024

The British Armed Forces have successfully tested a revolutionary Radio Frequency Directed Energy Weapon (RFDEW) capable of neutralizing drone swarms at a fraction of conventional defense costs. The system, developed by a UK-based consortium led by Thales, can disable multiple unmanned aerial systems for as little as 10 pence per engagement.

The British Armed Forces have successfully tested a revolutionary Radio Frequency Directed Energy Weapon (RFDEW) capable of neutralizing drone swarms at a fraction of conventional defense costs. The system, developed by a UK-based consortium led by Thales, can disable multiple unmanned aerial systems for as little as 10 pence per engagement. - Slovakia Acquires Israeli BARAK MX Air Defense Systems for €560 million Dec 23, 2024

Representatives of the Israeli and Slovakian Defense ministries have Signed a 560 million Euro Agreement to deliver the Barak MX Integrated Air Defense System Produced by IAI. Barak MX and Barak 8 air defense systems are currently operational with several nations. The Slovakian acquisition is important in integrating the BARAK MX system into the NATO air defense network, which could pave the system’s entry into other Alliance members.

Representatives of the Israeli and Slovakian Defense ministries have Signed a 560 million Euro Agreement to deliver the Barak MX Integrated Air Defense System Produced by IAI. Barak MX and Barak 8 air defense systems are currently operational with several nations. The Slovakian acquisition is important in integrating the BARAK MX system into the NATO air defense network, which could pave the system’s entry into other Alliance members. - XTEND Defense Secures $8.8M Contract for AI-Driven Tactical Loitering Munitions Dec 22, 2024

XTEND, an AI-driven drone technology expert, has been awarded an $8.8 million contract by the U.S. Department of Defense to supply VR-operated Precision Strike Indoor & Outdoor (PSIO) small Unmanned Aerial Systems (sUAS), a first DoD-approved loitering munition platform for both indoor and outdoor operations. With cutting-edge artificial intelligence (AI), these tactical drones deliver real-time, high-precision strikes, redefining smart munitions in modern warfare.

XTEND, an AI-driven drone technology expert, has been awarded an $8.8 million contract by the U.S. Department of Defense to supply VR-operated Precision Strike Indoor & Outdoor (PSIO) small Unmanned Aerial Systems (sUAS), a first DoD-approved loitering munition platform for both indoor and outdoor operations. With cutting-edge artificial intelligence (AI), these tactical drones deliver real-time, high-precision strikes, redefining smart munitions in modern warfare. - The PLA’s Global Power Play: A Deep Dive Into China’s Military Strategy and Ambitions Dec 18, 2024

The US Department of Defense’s annual report on Chinese military and security developments was presented to Congress today. In this post and podcast, we dissect the report, which isn’t just another geopolitical overview. It’s a deep dive into the PRC’s strategic ambitions as viewed by the West, a review of China’s military modernization efforts and implications for the international order. Loading the Elevenlabs Text to Speech AudioNative Player… We’ll start by exploring the core tenets of the PRC’s national strategy, focusing on its long-term goal of achieving “the great rejuvenation of the Chinese nation” by 2049. We’ll then analyze how this overarching strategy influences the country’s foreign, economic, and defense policies, including its view of the international system and its relationship with the United States. Then, we’ll shift our attention to the People’s Liberation Army (PLA), examining its modernization goals, current capabilities, and future aspirations. We’ll discuss the PLA’s aims to become a “world-class” military and the key milestones along this path—specifically the 2027, 2035, and 2049 objectives. This will include an assessment of the PLA’s progress in areas like: Hypersonic missiles and Ballistic Missiles Naval expansion and its transition to “open seas protection” Air Force modernization AI integration into warfare Cyber warfare and cognitive domain operations Space and counter-space capabilities Nuclear force modernization, including developing a sea-based nuclear deterrent and an increasing nuclear stockpile. We’ll also address China’s growing global presence through overseas military activities, including its counterterrorism strategy, expanding military logistics, and basing infrastructure. We’ll examine the Belt and Road Initiative (BRI) and its sub-efforts and consider how the PRC uses its economic policies and foreign influence to advance its strategic goals. We’ll discuss the PRC’s efforts to shape international perceptions through influence operations, including disinformation and cognitive warfare. Finally, we will address the critical issue of military-to-military communication between the United States and the PRC and the challenges to maintaining ...

The US Department of Defense’s annual report on Chinese military and security developments was presented to Congress today. In this post and podcast, we dissect the report, which isn’t just another geopolitical overview. It’s a deep dive into the PRC’s strategic ambitions as viewed by the West, a review of China’s military modernization efforts and implications for the international order. Loading the Elevenlabs Text to Speech AudioNative Player… We’ll start by exploring the core tenets of the PRC’s national strategy, focusing on its long-term goal of achieving “the great rejuvenation of the Chinese nation” by 2049. We’ll then analyze how this overarching strategy influences the country’s foreign, economic, and defense policies, including its view of the international system and its relationship with the United States. Then, we’ll shift our attention to the People’s Liberation Army (PLA), examining its modernization goals, current capabilities, and future aspirations. We’ll discuss the PLA’s aims to become a “world-class” military and the key milestones along this path—specifically the 2027, 2035, and 2049 objectives. This will include an assessment of the PLA’s progress in areas like: Hypersonic missiles and Ballistic Missiles Naval expansion and its transition to “open seas protection” Air Force modernization AI integration into warfare Cyber warfare and cognitive domain operations Space and counter-space capabilities Nuclear force modernization, including developing a sea-based nuclear deterrent and an increasing nuclear stockpile. We’ll also address China’s growing global presence through overseas military activities, including its counterterrorism strategy, expanding military logistics, and basing infrastructure. We’ll examine the Belt and Road Initiative (BRI) and its sub-efforts and consider how the PRC uses its economic policies and foreign influence to advance its strategic goals. We’ll discuss the PRC’s efforts to shape international perceptions through influence operations, including disinformation and cognitive warfare. Finally, we will address the critical issue of military-to-military communication between the United States and the PRC and the challenges to maintaining ... - Greece’s Land Forces to Get Switchblade Loitering Weapons and Advanced Rocket Launchers Dec 18, 2024

Greece is actively modernizing its military capabilities with two significant procurements. Firstly, the Government Council for Foreign and Defense Affairs, known as KYSEA, has approved the purchase of approximately 590 U.S.-made Switchblade loitering munitions, commonly called “kamikaze drones.” These include the Switchblade 300 and Switchblade 600 models, designed for precision strikes against personnel, light vehicles, and armored targets. This acquisition costs around €75.2 million, with Greece contributing €25 million and the remainder financed through U.S. foreign military funding. In addition to the drone procurement, Greece is in advanced discussions to acquire 36 PULS rocket artillery systems from Israel. The PULS, or Precise and Universal Launching System, developed by Elbit Systems, is a versatile rocket artillery platform capable of launching various rockets with ranges up to 300 kilometers. This deal, estimated between €600 and €700 million, also includes provisions for constructing components within Greece, fostering local industry collaboration. These acquisitions align with Greece’s broader strategy to modernize its armed forces and enhance its defense posture amid regional tensions. After transferring older Soviet-era equipment to Ukraine, Greece will also replenish and upgrade its military inventory. Greece has provided Ukraine with various military aid, including BMP-1A1 infantry fighting vehicles, RPG-18 grenade launchers, Kalashnikov rifles, and 122mm rocket artillery rounds. This support is part of international efforts to bolster Ukraine’s defense capabilities amid ongoing conflicts. With these acquisitions, Greece ensures its military remains robust and capable by replacing outdated systems with advanced technology like the Switchblade drones and PULS artillery systems. Simultaneously, transferring older equipment to Ukraine underscores Greece’s commitment to supporting allies and contributing to regional stability. Loading the Elevenlabs Text to Speech AudioNative Player… In summary, Greece’s strategic acquisitions and equipment transfers reflect a dual approach: strengthening its defense capabilities while supporting international partners in need. This balanced strategy enhances Greece’s military readiness and reinforces its role ...

Greece is actively modernizing its military capabilities with two significant procurements. Firstly, the Government Council for Foreign and Defense Affairs, known as KYSEA, has approved the purchase of approximately 590 U.S.-made Switchblade loitering munitions, commonly called “kamikaze drones.” These include the Switchblade 300 and Switchblade 600 models, designed for precision strikes against personnel, light vehicles, and armored targets. This acquisition costs around €75.2 million, with Greece contributing €25 million and the remainder financed through U.S. foreign military funding. In addition to the drone procurement, Greece is in advanced discussions to acquire 36 PULS rocket artillery systems from Israel. The PULS, or Precise and Universal Launching System, developed by Elbit Systems, is a versatile rocket artillery platform capable of launching various rockets with ranges up to 300 kilometers. This deal, estimated between €600 and €700 million, also includes provisions for constructing components within Greece, fostering local industry collaboration. These acquisitions align with Greece’s broader strategy to modernize its armed forces and enhance its defense posture amid regional tensions. After transferring older Soviet-era equipment to Ukraine, Greece will also replenish and upgrade its military inventory. Greece has provided Ukraine with various military aid, including BMP-1A1 infantry fighting vehicles, RPG-18 grenade launchers, Kalashnikov rifles, and 122mm rocket artillery rounds. This support is part of international efforts to bolster Ukraine’s defense capabilities amid ongoing conflicts. With these acquisitions, Greece ensures its military remains robust and capable by replacing outdated systems with advanced technology like the Switchblade drones and PULS artillery systems. Simultaneously, transferring older equipment to Ukraine underscores Greece’s commitment to supporting allies and contributing to regional stability. Loading the Elevenlabs Text to Speech AudioNative Player… In summary, Greece’s strategic acquisitions and equipment transfers reflect a dual approach: strengthening its defense capabilities while supporting international partners in need. This balanced strategy enhances Greece’s military readiness and reinforces its role ... - Weekly News Summary – Week Ended 15 December 2024 Dec 16, 2024Preparing to continue our weekly review, we are utilizing AI systems to organize, process, and present a weekly news summary covering defense tech. There is still a long way to go; we’d like some topics to delve deeper, others placed in different order, but overall, we were impressed. Even at this early stage, we feel that the results are incredible. So ,we decided to upload the discussion and let you decide. Is it worth 22 minutes of your time? I certainly enjoyed listening. Send your comments to: Have a comment? send us an email!

- Deep Dive – Oreshnik IRBM Nov 23, 2024

Multiple sources reported today on Russia’s use of a new medium-range ballistic missile, the Oreshnik, based on the existing RS-26 Rubezh. The Oreshnik, described as experimental and hypersonic, was used in a strike on Dnipro, Ukraine. Controversy exists regarding Russia’s notification of the launch to the U.S., with differing statements from Russian and U.S. officials. The RS-26, originally an ICBM, has a history shrouded in secrecy, with development starting before the INF treaty’s collapse and its later purported cancellation. The missile’s capabilities, including its payload and range, remain partially unclear. This three-part podcast covers this alarming and unexpected development in detail. This episode utilizes AI-generated audio based on Defense-Update research and analysis of the recent Russian missile attack using six Oreshnik Intermediate Range Ballistic Missiles (IRBM) using 36 warheads on Dnipro, Ukraine. Using a conventionally armed IRBM is likely a Russian response to recent US and its allies (France and UK) recent decisions. It delivered a clear message all over Europe.

Multiple sources reported today on Russia’s use of a new medium-range ballistic missile, the Oreshnik, based on the existing RS-26 Rubezh. The Oreshnik, described as experimental and hypersonic, was used in a strike on Dnipro, Ukraine. Controversy exists regarding Russia’s notification of the launch to the U.S., with differing statements from Russian and U.S. officials. The RS-26, originally an ICBM, has a history shrouded in secrecy, with development starting before the INF treaty’s collapse and its later purported cancellation. The missile’s capabilities, including its payload and range, remain partially unclear. This three-part podcast covers this alarming and unexpected development in detail. This episode utilizes AI-generated audio based on Defense-Update research and analysis of the recent Russian missile attack using six Oreshnik Intermediate Range Ballistic Missiles (IRBM) using 36 warheads on Dnipro, Ukraine. Using a conventionally armed IRBM is likely a Russian response to recent US and its allies (France and UK) recent decisions. It delivered a clear message all over Europe. - Diehl’s Sky Sphere set to Defeat UAS, OWA Drones Head-On Nov 9, 2024

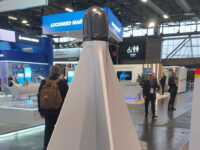

Diehl Defence has teamed up with Skysec to develop a drone interceptor. Diehl works with Skysec’s subsidiary, Skysec Defence, to modify the original civilian-oriented net-arresting interceptor into a hard-kill system suitable for military missions. Armasuisse, the Swiss Federal Office of Armaments, backs the program. Sky Sphere has undergone initial test flights without a live warhead. According to company sources, the system could be matured within 18-24 months. Earlier this month, Diehl displayed an innovative C-UAS system called ‘Sky Sphere.’ Using a kinetic effector designed specifically for this mission, this system complements other air defense capabilities by engaging small, slow, and low-flying targets such as unmanned aerial vehicles, one-way attack drones, and multi-rotors. The weapon relies on target data from a radar or EO system that detects, classifies, and tracks the flying object as hostile. Launched from a container/launcher, the interceptor accelerates toward the target through the midcourse flight, flying at a 200 km/h speed using the high RPM electrical engine. Reaching the target vicinity, it activates its active RF seeker to maneuver the end game. Onboard battery power supports 4-5 minutes of flight at this speed, enabling successful engagements beyond five kilometers, close in, and maneuver toward the target to engage it head-on. The high-explosive fragmenting warhead is optimized to defeat soft targets such as OWA UAVs within a 10-meter sphere. The seeker is at the front, followed by the rotor, engine, power source, and electronic circuitry. The warhead is situated at the rear end of the airframe, optimizing the lethal effect of a relatively small charge on the target. The original (non-kinetic) interceptor developed by Skysec utilized a net and parachute to neutralize a small drone flying over a restricted area, such as an airfield, with minimal collateral risk. At a length of 700 mm and diameter of 300 mm, it weighs 1.8 ...

Diehl Defence has teamed up with Skysec to develop a drone interceptor. Diehl works with Skysec’s subsidiary, Skysec Defence, to modify the original civilian-oriented net-arresting interceptor into a hard-kill system suitable for military missions. Armasuisse, the Swiss Federal Office of Armaments, backs the program. Sky Sphere has undergone initial test flights without a live warhead. According to company sources, the system could be matured within 18-24 months. Earlier this month, Diehl displayed an innovative C-UAS system called ‘Sky Sphere.’ Using a kinetic effector designed specifically for this mission, this system complements other air defense capabilities by engaging small, slow, and low-flying targets such as unmanned aerial vehicles, one-way attack drones, and multi-rotors. The weapon relies on target data from a radar or EO system that detects, classifies, and tracks the flying object as hostile. Launched from a container/launcher, the interceptor accelerates toward the target through the midcourse flight, flying at a 200 km/h speed using the high RPM electrical engine. Reaching the target vicinity, it activates its active RF seeker to maneuver the end game. Onboard battery power supports 4-5 minutes of flight at this speed, enabling successful engagements beyond five kilometers, close in, and maneuver toward the target to engage it head-on. The high-explosive fragmenting warhead is optimized to defeat soft targets such as OWA UAVs within a 10-meter sphere. The seeker is at the front, followed by the rotor, engine, power source, and electronic circuitry. The warhead is situated at the rear end of the airframe, optimizing the lethal effect of a relatively small charge on the target. The original (non-kinetic) interceptor developed by Skysec utilized a net and parachute to neutralize a small drone flying over a restricted area, such as an airfield, with minimal collateral risk. At a length of 700 mm and diameter of 300 mm, it weighs 1.8 ... - Defense Update Weekly News Summary Oct 13, 2024

Welcome to the latest episode of Defense-Update News Summary! In this episode, we dive into this week’s developments in defense technology, military acquisitions, and strategic partnerships worldwide. Some of this week’s highlights include: Elbit Systems Address US Army Artillery Modernization with Sigma 155×52 Wheeled Howitzer Unmanned Combat Aerial Vehicle Program Launches as Part of Rafale F5 Standard Steadicopter Unveils Golden Eagle HS ATGM Launching Aerial Platform Air Defense & C-UAS Innovations at the AUSA 2024 Exhibition View last week’s News Summary For more in-depth analysis and defense updates, visit our website: https://defense-update.com

Welcome to the latest episode of Defense-Update News Summary! In this episode, we dive into this week’s developments in defense technology, military acquisitions, and strategic partnerships worldwide. Some of this week’s highlights include: Elbit Systems Address US Army Artillery Modernization with Sigma 155×52 Wheeled Howitzer Unmanned Combat Aerial Vehicle Program Launches as Part of Rafale F5 Standard Steadicopter Unveils Golden Eagle HS ATGM Launching Aerial Platform Air Defense & C-UAS Innovations at the AUSA 2024 Exhibition View last week’s News Summary For more in-depth analysis and defense updates, visit our website: https://defense-update.com - Unmanned Combat Aerial Vehicle Program Launches as Part of Rafale F5 Standard Oct 13, 2024

The French Ministry of Armed Forces has officially launched the Unmanned Combat Aerial Vehicle (UCAV) program as part of the Rafale F5 standard development. This event marks the beginning of a new era in aerial combat capabilities for the French Air and Space Force and Navy. The UCAV program aims to develop a combat drone that will operate alongside the Rafale fighter jet, enhancing its capabilities and expanding its operational range. This UAV will complement the Rafale and be suited to collaborative combat. It will incorporate stealth technologies, autonomous control (with man-in-the-loop), internal payload capacity, and more. It will be highly versatile and designed to evolve in line with future threats. As part of the Rafale F5 program, the UCAV will fully integrate into the fighter jet’s systems, allowing seamless coordination and data sharing. This integration will enable the Rafale to extend its sensor reach, engage targets at greater distances, and perform high-risk missions without putting pilots in harm’s way. The program is set to leverage advanced technologies in artificial intelligence, secure communications, and autonomous systems to ensure the UCAV’s effectiveness in complex operational environments. The UCAV will benefit from the achievements of the nEUROn program, Europe’s first stealth UCAV demonstrator. Initiated in 2003, the nEUROn program brought together the aeronautics resources of six European countries, with project management by Dassault Aviation. nEUROn completed its maiden flight in December 2012. More than 170 test flights have been conducted to date. The nEUROn program has lived up to all its promises regarding performance levels, lead times, and budget. Saab and KAI Partner to Offer GlobalEye AEW&C System to South Korea Saab and Korea Aerospace Industries (KAI) have signed a Memorandum of Understanding (MoU) to collaborate on offering the GlobalEye Airborne Early Warning and Control (AEW&C) system to the Republic of Korea Air Force (ROKAF). This partnership ...

The French Ministry of Armed Forces has officially launched the Unmanned Combat Aerial Vehicle (UCAV) program as part of the Rafale F5 standard development. This event marks the beginning of a new era in aerial combat capabilities for the French Air and Space Force and Navy. The UCAV program aims to develop a combat drone that will operate alongside the Rafale fighter jet, enhancing its capabilities and expanding its operational range. This UAV will complement the Rafale and be suited to collaborative combat. It will incorporate stealth technologies, autonomous control (with man-in-the-loop), internal payload capacity, and more. It will be highly versatile and designed to evolve in line with future threats. As part of the Rafale F5 program, the UCAV will fully integrate into the fighter jet’s systems, allowing seamless coordination and data sharing. This integration will enable the Rafale to extend its sensor reach, engage targets at greater distances, and perform high-risk missions without putting pilots in harm’s way. The program is set to leverage advanced technologies in artificial intelligence, secure communications, and autonomous systems to ensure the UCAV’s effectiveness in complex operational environments. The UCAV will benefit from the achievements of the nEUROn program, Europe’s first stealth UCAV demonstrator. Initiated in 2003, the nEUROn program brought together the aeronautics resources of six European countries, with project management by Dassault Aviation. nEUROn completed its maiden flight in December 2012. More than 170 test flights have been conducted to date. The nEUROn program has lived up to all its promises regarding performance levels, lead times, and budget. Saab and KAI Partner to Offer GlobalEye AEW&C System to South Korea Saab and Korea Aerospace Industries (KAI) have signed a Memorandum of Understanding (MoU) to collaborate on offering the GlobalEye Airborne Early Warning and Control (AEW&C) system to the Republic of Korea Air Force (ROKAF). This partnership ...

Research Focus: Singapore Defense Market

The Singapore Defense Industry Market Opportunities and Entry Strategies, Analyses and Forecasts to 2016

Singapore has the largest defense expenditure in South East Asia, and, in 2008, the country had the world’s fourth-largest per capita defense expenditure, behind only Israel, the US and Oman. The country’s defense expenditure is high due to the small size of the country’s armed forces and consequent ever-present requirement to upgrade the country’s defense equipment and procure advanced technology in order to compensate for the country’s lack of manpower.

The full 151 page report (dated December 2011) is available from Defense-Update ICD for $1,250.-

Send your request to ICD sales department.

Singapore has the largest defense expenditure in the South East Asian region, and the country’s defense spending is expected to increase substantially by 2016. The country’s defense expenditure is primarily driven by the threat of terrorist organizations such as Jemaah Islamiah, and the country’s focus on the protection of important trade routes, such as the Strait of Singapore and the Strait of Malacca, from the threat of piracy. Singapore’s army is relatively small, resulting in the country using technology as a force multiplier, another factor which increases its defense expenditure. The country’s small size also renders it unable to provide adequate training facilities for its armed forces personnel. As such, the country relocates army training facilities to foreign countries, a decision that creates the need to purchase training stations and detachments overseas.

From 2011 to 2016, (the forecast period), Singapore is expected to invest in advanced technology for its armed forces, including purchases in areas such as such as stealth technology, unmanned technology and precision guided systems. Homeland security expenditure is also expected to increase the demand for CCTV, advanced electronic systems and biometric checking.

As Singapore is investing in advanced technology for its armed forces, it requires technology transfer agreements for all defense procurements in order to ensure future repair and maintenance and to enable the customization of equipment in accordance with the country’s needs. Additionally, Singapore’s FDI (Foreign Direct Investment) policy allows foreign defense companies to establish a fully-owned subsidiary in the country and, in order to further encourage investment, favorable tax laws also exist for foreign companies.

Singapore procures the majority of its defense equipment from foreign companies, with its defense imports driven by the country’s policy of utilizing technology to improve the efficiency of its armed forces. Some of Singapore’s major defense imports include arms, ships, missile systems and armored vehicles. Historically, the largest supplier of arms to Singapore was the US; however, from 2005 to 2010 (the review period), countries such as France and Germany have made substantial inroads into the country’s defense industry.

The Singaporean Government prefers technology transfer agreements for defense equipment acquisitions, and, as a result, this is the most common route for original equipment manufacturers (OEMs) to enter the domestic defense industry. In order to procure spare parts and other common equipment, the government also has an online portal, the Ministry of Defense Internet Procurement System (MIPS), through which registered suppliers are issued with a smart card, and only such companies are allowed to enter the bidding process for defense equipment. Defense suppliers obtain a smart card through registration with the defense ministry. Additionally, Singapore has devised an innovative procurement method through lease-to-own arrangements, a policy that substantially reduces initial capital investment, gives Singapore early access to advanced defense equipment and reduces Foreign Military Sales (FMS) commission. Foreign OEMs can therefore enter Singapore’s defense industry by offering equipment through lease-to-own arrangements.

Singapore is a relatively small country, with a total land mass of 710 square kilometers. The size of the country limits the land available for the establishment of manufacturing facilities, a factor which acts as a barrier for foreign companies considering investing in Singapore. The country’s declining birth rate, small population and resultant labor shortage also act as barriers to entry. The country’s acute land shortage is reflected by the fact that the Singaporean Government trains military personnel at foreign facilities.

For more information on “The Singapore Defense Industry Market Opportunities and Entry Strategies, Analyses and Forecasts to 2016″ (product ID: # Defense-Update DF0074MR Request for Quotation). The report is available in electronic form from ICD. Single User License costs: $1,250.-

To order this report and request more information please contact: Rosezena Pare