Visiting the UMEX & SimTEX 2026 exhibition taking place at the ADNEC Centre in Abu Dhabi this week, a new system caught our attention. Slovenian company Carboteh has introduced an unconventional approach to protecting ground forces from low-flying aircraft and helicopters. The Battlefield Anti-Aircraft Non-Kinetic (BANS) system represents a departure from traditional very short-range air defense (VSHORAD) tactics, employing electronic warfare deception principles to create tactical dilemmas for hostile pilots without firing a single missile.

The operational concept behind BANS derives from threat simulators used in helicopter and aircraft crew training. These simulators replicate air defense threats during training missions, allowing pilots to practice responding to missile launches in controlled environments. Carboteh has adapted this training technology into a handheld, field-deployable weapon system designed to exploit the automated defensive responses built into modern military aircraft and to support pilot self-protection threat-evasion procedures.

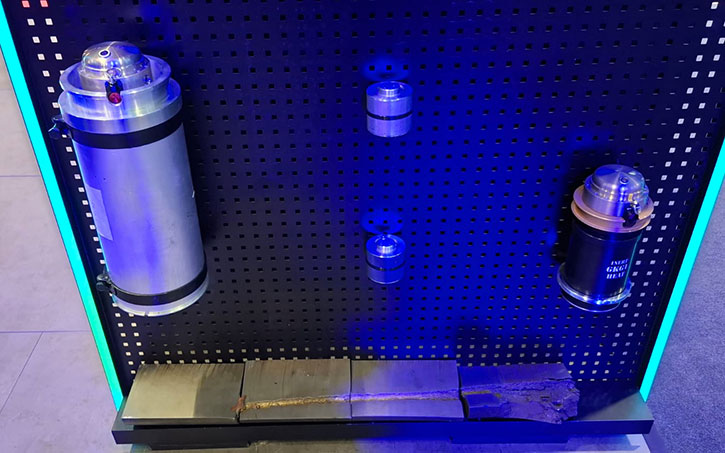

At its core, BANS is a deception system that simulates the ultraviolet signature of a surface-to-air missile launch. The device emits UV light in the solar-blind spectrum (up to 300 nm) that replicates the distinctive pattern of an anti-aircraft missile’s flight path. This signature is specifically calibrated to trigger both NATO-standard missile warning systems and Russian systems such as the Vitebsk L370-2 and various MAK-series units.

When an aircraft’s Missile Warning System (MWS) detects what it interprets as an incoming missile, it automatically responds according to its programming, dispensing infrared flares and alerting the pilot, who typically initiates evasive maneuvers. This response is precisely what BANS is designed to provoke.

Operational Concept

The system operates in a three-phase engagement sequence:

Phase 1 – Digital Stimulation: The BANS device emits a specialized UV signal that mimics a SAM launch signature, triggering the target aircraft’s missile-warning and detection systems.

Phase 2 – Forced Countermeasure Dispensing: The aircraft automatically dispenses defensive flares in response to the perceived threat, believing itself under attack.

Phase 3 – Induced Vulnerability: With its countermeasures depleted or reduced, the aircraft becomes significantly more vulnerable to actual kinetic weapons, particularly infrared-guided MANPADS.

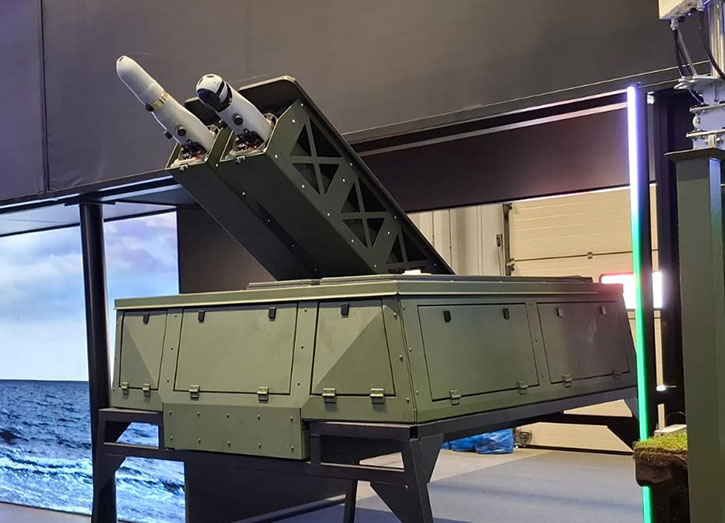

BANS is available in two primary configurations: a handheld unit resembling an assault rifle and a tripod-mounted system. Both versions share core specifications designed for battlefield portability and endurance:

- Operational Range: 5-6 km

- Effective Altitude: Up to 3,000 meters

- Elevation Coverage: 10° to 75°

- Weight: Approximately 4 kg (handheld version)

- Endurance: 500 activations per dual battery charge

- LED Life Expectancy: Over 30,000 shots

- Environmental Protection: IP56 rating (dust and waterproof)

The handheld version features a red dot sight, folding stock, front grip, and trigger mechanism, making it intuitive for operators familiar with small arms. According to Carboteh, the system requires minimal specialized training.

The primary value proposition of BANS lies in its role as an enhancement for existing air defense assets. Rather than replacing MANPADS, it’s designed to complement them through several tactical applications:

Countermeasure Depletion: By forcing aircraft to expend flares repeatedly, BANS can exhaust their limited defensive payload before actual missiles are launched. Military helicopters and attack aircraft typically carry finite countermeasure loads; once depleted, they become significantly more vulnerable to heat-seeking weapons.

The system’s low weight, cost, and training requirements enable large-scale deployment. Multiple BANS operators can create overlapping fields of simulated threats, triggering repeated defensive responses across a wide area and rapidly depleting an aircraft’s countermeasures.

Perceived Threat Density: In scenarios where MANPADS coverage is thin or non-existent, BANS can create the perception of a much denser air defense environment. Pilots facing constant missile warnings may abort missions, alter flight paths, or operate with reduced effectiveness even if few actual kinetic systems are present. In areas where MANPADS are present, BANS activation could draw the target’s attention to the deception, thereby improving the kill probability of the actual MANPADS employed.

Mission Disruption: Even without achieving a kill, continuously forcing pilots to respond to perceived threats imposes cognitive load, depletes resources, and can ultimately lead to mission abort decisions.

Integration and Deployment Options

Beyond handheld use, BANS can be integrated into various platform configurations. The system can be mounted on remote weapon stations (RWS), unmanned ground vehicles (UGVs), naval platforms, and border security installations. When mounted on a pan-tilt mechanism, it offers 360-degree coverage and can engage targets at elevations from 10° to 75 °. Integration with electro-optical sensors and radar systems enables automated targeting, while high-resolution cameras enable precise aiming and battle-damage assessment. This versatility means BANS can function as part of a layered defense network or operate independently in forward positions.

The introduction of BANS reflects a broader trend in military technology toward unconventional and non-kinetic effects, such as electronic warfare systems and interceptor drones. At a fraction of the cost of traditional SAMs, BANS allows ground forces to engage hostile aircraft thousands of times for only the cost of battery recharging. A single MANPADS missile can cost tens of thousands of dollars; BANS offers unlimited engagements with minimal recurring costs.

For the defending forces, this creates an asymmetric advantage. Small units can project air defense capabilities beyond their actual kinetic capacity, complicating enemy planning and forcing pilots to treat every threat indication seriously, even when it may be a deception. Pilots must choose between responding to every missile warning (and potentially exhausting countermeasures against phantom threats) or ignoring warnings (and risking destruction by actual missiles). This dilemma is particularly acute in environments where BANS is deployed alongside real MANPADS.

However, the system may pose a threat to exposed operators, as the targeted MWS also displays the quadrant from which the perceived threat is coming, potentially placing the operator in danger from the targeted plane or its wingman.

The system’s effectiveness depends on several factors. Aircraft must be equipped with UV-sensitive missile warning systems for BANS to trigger their defenses. The operational range of 5-6 km and effective altitude of 10,000 ft (3,000 m) are considerably shorter than those of many MANPADS, meaning it’s most effective against low-flying aircraft and helicopters operating in the very short-range envelope.

Weather conditions, particularly visibility and atmospheric interference, may affect performance. Additionally, as with any electronic warfare system, adversaries may eventually develop countermeasures or adjust tactics once they understand the threat.

BANS represents an innovative approach to the persistent challenge of defending ground forces from air attack. By transforming training technology into a tactical weapon, Carboteh has created a system that exploits the automated defensive systems that make modern aircraft survivable. Whether BANS proves to be the “war changer” its developers claim will depend on battlefield performance and enemy adaptation. However, it undeniably adds a new dimension to the cat-and-mouse game of air defense, where deception may prove as valuable as destruction.

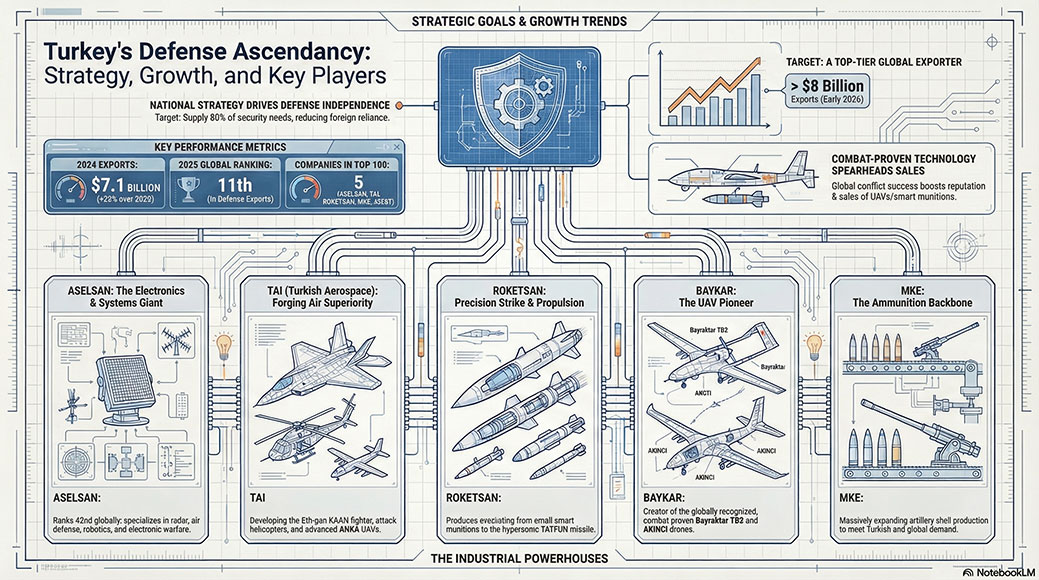

The opening week of 2026 has been defined by a singular, paradigmatic shift in modern warfare: the “catastrophic failure” of Venezuela’s integrated air defense network during a U.S. special operation. This event serves as a brutal real-world validation of the trends currently dominating defense news, specifically the supremacy of advanced electronic warfare (EW) over legacy kinetic defenses and the critical need for next-generation situational awareness. The operation, which resulted in the capture of President Maduro, succeeded not through brute force, but by rendering Venezuela’s Russian S-300VM and Chinese “anti-stealth” radars effectively blind. This failure of Eastern-bloc hardware to detect or engage U.S. forces has sent shockwaves through the global market, underscoring why nations like Spain and Germany are rushing to modernize their air defense architectures with Western alternatives, such as the Patriot system.

The opening week of 2026 has been defined by a singular, paradigmatic shift in modern warfare: the “catastrophic failure” of Venezuela’s integrated air defense network during a U.S. special operation. This event serves as a brutal real-world validation of the trends currently dominating defense news, specifically the supremacy of advanced electronic warfare (EW) over legacy kinetic defenses and the critical need for next-generation situational awareness. The operation, which resulted in the capture of President Maduro, succeeded not through brute force, but by rendering Venezuela’s Russian S-300VM and Chinese “anti-stealth” radars effectively blind. This failure of Eastern-bloc hardware to detect or engage U.S. forces has sent shockwaves through the global market, underscoring why nations like Spain and Germany are rushing to modernize their air defense architectures with Western alternatives, such as the Patriot system.

Defense & Security Implications

Defense & Security Implications