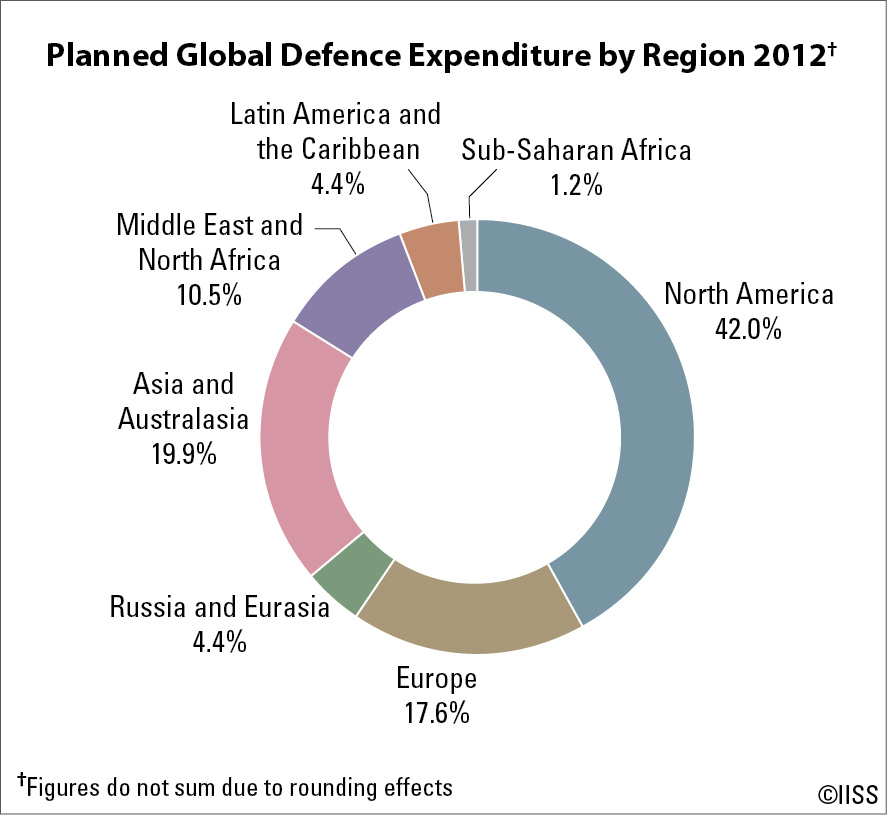

The World Military Balance 2013 published by the International Institute of Strategic Studies (IISS) reflects the recent trends in the global redistribution of military power. Reflecting the subdued global economic climate, total defence spending fell in real terms in 2012 for a second year running. However, real increases were seen in the Middle East and North Africa, Russia and Eurasia, Latin America and in Asia, while real declines were seen in North America and Europe. As predicted by IISS last year, the report indicated nominal Asian defence spending overtake that of NATO European states for the first time in 2012.

This is not simply a result of Asia spending more; it is as much a result of states in Europe spending less. In 2012, European NATO members’ defence spending was, in real terms, around 11% lower than in 2006. This reduction continues to shape military capabilities, and especially in the United Kingdom, France, Germany, Italy and Spain which account for almost 70% of European spending. According to IISS data, total military personnel in European NATO states have reduced from 2.51 million in 2000 to 1.86m for the same set of states now, a decline in excess of 25%. The intention was that reduced numbers, when combined with structural reforms, would produce an increase in the usability of armed forces. But in many European countries, this has not happened. The budget crisis exacerbates the trend. Regardless of their strategic intent to maintain forces suited to present-day needs, defence ministries are playing ‘catch-up’, adjusting force structures to match immediate financial priorities.

Related Reports:

Global Defense Survey 2013

Business Outlook, Key Markets and Opportunities

In 2011, European capability gaps were underscored by the war in Libya. The 2013 operation in Mali again highlighted shortcomings in airborne refueling, airlift and ISR. Discussions on pooling, sharing and role specialisation continue, and NATO promotes its ‘smart defence’ initiative. But progress towards better cooperation remains limited, with national capitals concerned about loss of sovereignty and jobs. This is occurring as it becomes ever more clear that Europe should not presume that the US will provide the same level of operational support. The restricted nature of the US role in Libya, and again this year in Mali, could be seen as an incentive for European countries to work together to develop a wider spectrum of capabilities. But there is little sign of this happening.

Defence spending is also in decline in the United States. The Pentagon was already implementing cuts of $487 billion over five years, and as a result of sequestration will now need to make additional reductions of $600bn over ten years. The inflexible design of sequestration and the exemption of military personnel accounts from the process limit the DoD’s room for manoeuvre.

It needs to be remembered, however, that the defence budget of the United States still dominates the world’s defense spending, and the United States still intends to remain engaged globally. Although much has been said about ‘rebalancing’ to the Pacific, in military terms there is less to this than first appeared. It will of course be important in the longer term, but the rebalance should mainly be seen as a signal that the US will remain engaged in Asia-Pacific security, reflecting not just US economic ties to the region but also the emergence of China as a regional competitor in both economic and military terms.

China’s indigenous capacity to produce advanced equipment is gradually transforming the People’s Liberation Army. China’s rise, and its growing strategic reach, was illustrated by the commissioning of its first aircraft carrier in September, and the first at-sea landing of the J-15 combat aircraft two months later. But China is still learning how to operate carriers, the J-15 remains largely developmental and the PLA Navy’s ability to carry out integrated carrier task group operations remains embryonic. Attention should also be paid to the new Type-052D destroyer, possibly designed to provide a blue-water air-warfare destroyer capability, the modular Type-056 corvettes, and new maritime patrol aircraft as well as recent developments in China’s guided weapons systems.

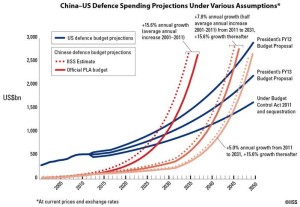

China’s military developments are fuelled by continuing increases in defence spending, witnessed by the 10.7% rise in its official defence budget announced last week. China now spends more on defence than neighbouring Japan, South Korea and Taiwan combined. When might Chinese spending rival that of the United States? If the 15% average annual increasesin China’s official defence spending seen over the past decade continue into the medium term, Chinese defence outlays could rival US base defence-budget spending by 2025. If additional elements of military spending widely believed to be excluded from the official PLA budget are included, convergence could occur in 2023, just a decade away. The graph above shows a comparison of China-US defence spending projections under various assumptions.