This edition of the DefenseTech Brief covers the week of April 21-27, 2025, a period marked by significant developments across multiple defense technology domains. Key highlights include the US Army’s critical decision to move the LTAMDS radar into production, bolstering Patriot air defenses, alongside a major funding proposal for the ambitious “Golden Dome” homeland missile defense initiative. The underwater realm saw continued focus on seabed infrastructure security and advancements in uncrewed systems. Counter-UAS activity remained intense with new partnerships, technologies, and international deals, including the notable effectiveness of systems like the Iranian Project 358 missile. European land forces modernization featured updates on major programs like Challenger 3, Leopard 2A8, Leclerc XLR, Ajax, and the successful CV-90, while future tank development showed signs of fragmentation. Other notable events included major defense spending announcements, hypersonic program contracts, and space domain activities. This brief provides summaries, assessments, and investor insights for each key area.

Air & Missile Defense Developments

Key developments included the US Army approving Low-Rate Initial Production (LRIP) for Raytheon’s LTAMDS radar, a critical Patriot system upgrade now attracting significant international interest. LTAMDS technology is also enhancing NASAMS via the GhostEye MR radar. Concurrently, Congressional Republicans proposed $27 billion initial funding for the ambitious “Golden Dome” homeland missile defense initiative, expanding US policy scope significantly beyond previous rogue-state focus. This initiative, stemming from EO 14186, aims to counter diverse threats including hypersonics, involving major contractors like SpaceX and Lockheed Martin. Debates intensified over balancing costly active interceptors ($406M for 12 SM-3s) against passive defenses like hardened aircraft shelters (HAS), given rising airbase vulnerability to missiles and drones and constrained military construction budgets. Other updates included USAF orders for Lockheed Martin’s TPY-4 radars, exploration of low-cost C-UAS interceptors, and accelerated development of advanced Precision Strike Missile (PrSM) variants.

Assessment: The AMD landscape shows a dual focus: pursuing high-end, technologically advanced systems (LTAMDS, Golden Dome) to counter sophisticated peer threats, while simultaneously grappling with the proliferation of low-cost threats (drones) and the economic unsustainability of current countermeasures. The Golden Dome initiative represents a major, potentially destabilizing policy shift with significant technical and fiscal hurdles. Airbase vulnerability highlights a critical tension between investing in expensive interceptors versus affordable passive defenses like HAS, with current funding potentially misaligned with operational realities.

Investor Insights: Significant opportunities exist for prime contractors like Raytheon [NYSE: RTX] (LTAMDS, GhostEye MR, potentially Coyote C-UAS) and Lockheed Martin [NYSE:LMT] (THAAD, TPY-4, F-35 upgrades). The Golden Dome initiative, despite uncertainties, signals massive long-term investment potential, particularly in space-based sensors and interceptors, attracting interest from established players and newer entrants like SpaceX, Palantir [NASDAQ: PLTR], and Anduril. The C-UAS market remains hot, with demand for cost-effective interceptors. Investment in base hardening and military construction, though currently constrained, represents a potential growth area driven by clear operational needs.

Underwater Warfare & Seabed Security

Focus intensified on seabed security following infrastructure sabotage incidents (Nord Stream, Balticconnector), establishing the seabed as a distinct operational domain vulnerable to hybrid warfare tactics. Nations (France, EU) are developing specific doctrines and strategies. Uncrewed Underwater Vehicles (UUVs) are central to future capabilities (CUI protection, ASW, MCM, ISR), with R&D focused on autonomy, interoperability, data exploitation, and multi-platform deployment. Industry players like BAE Systems (XLAUV) and HII (Lionfish SUUV) showcased progress. Key naval platform news included Italy receiving its 9th FREMM frigate (Spartaco Schergat) in a new enhanced ASW/GP hybrid configuration, Russia announcing serial production readiness for the Arctic-focused Husky-10 hovercraft, and Denmark planning a major 25-vessel naval expansion.

Assessment: The seabed is now a recognized critical infrastructure battleground, demanding new technologies and doctrines. UUV/AUV advancements are key, but the underwater environment poses persistent challenges (pressure, communication, power). Mastering autonomy is crucial for future dominance, but UUV proliferation creates significant asymmetric threat risks. Naval investments reflect these trends, with a continued focus on advanced ASW platforms (FREMM) and specialized regional capabilities (Husky-10).

Investor Insights: The UUV/AUV market shows strong growth potential, driven by defense needs for seabed monitoring, ASW, and MCM. Companies specializing in underwater autonomy, sensors, power systems, and data analytics are well-positioned (e.g., BAE Systems [LON: BAES], HII [NYSE: HII], Thales [EPA: TCFP], Leonardo [BIT: LDO]). Investment in seabed infrastructure protection technologies and services is likely to increase. Major naval shipbuilding programs (FREMM, Danish expansion) offer opportunities for large shipbuilders (Fincantieri [BIT:FCT]) and their supply chains. Arctic-specific platforms (Husky-10) represent a niche but growing market.

Counter-Unmanned Aircraft Systems (C-UAS)

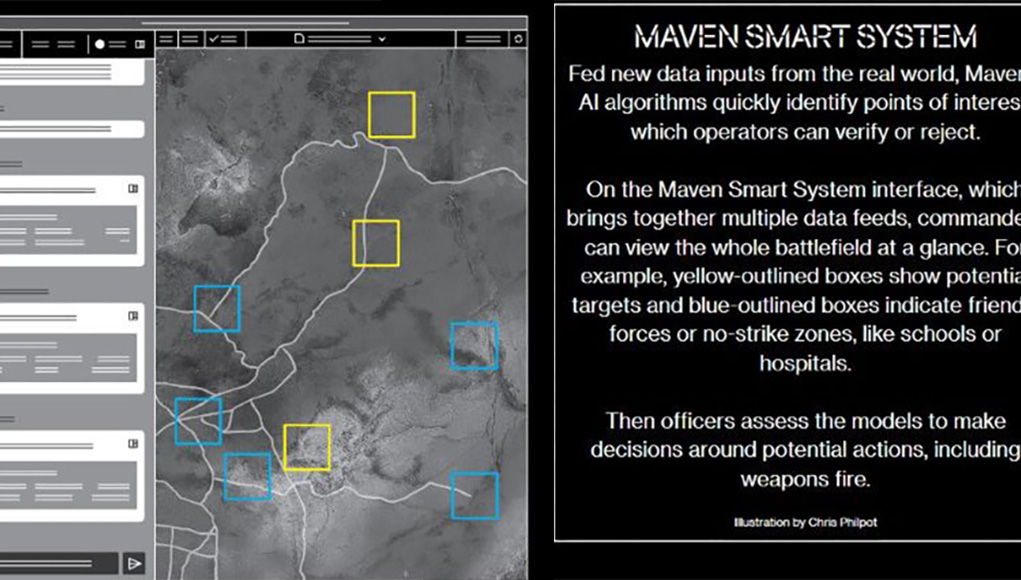

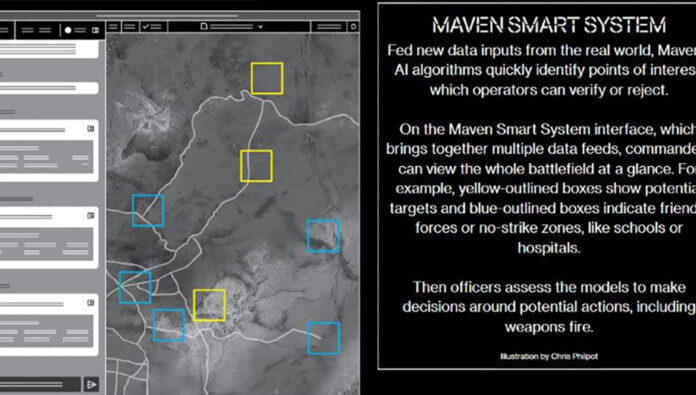

The C-UAS sector saw intense activity. The USAF issued RFIs for EW and sensor (radar/camera) capabilities. NATO tested a prototype sensor against GNSS threats. AI integration was prominent, with partnerships formed between MSI Defense/OVES Enterprise and Sentrycs/Xtend, and development efforts by ELT Group. The US Army conducted M-LIDS training. DZYNE Technologies launched a new Dronebuster variant for Europe. Raytheon signed a term sheet for potential Coyote C-UAS co-production in the UAE. Domestically, Florida considered legislation against drone misuse, and the DSCA added the “DRAKE” C-UAS system to FMS lists. New systems like the Hellhound, developed by Cummings Aerospace, offer modular payloads (ISR, EW, kinetic) and potential swarming capabilities. A hypersonic variant is also planned. Meanwhile, the Iranian-supplied Project 358 (Saqr-1) loitering surface-to-air missile has proven effective, used by Houthis and Hezbollah to down numerous high-value drones, including over 20 US MQ-9 Reapers over Yemen, and three Israeli Hermes 900s over Lebanon, highlighting the growing threat from sophisticated, lower-cost SAMs.

Assessment: The C-UAS field is highly dynamic, driven by urgent operational needs demonstrated in conflicts like Ukraine. Key technology trends include heavy reliance on AI/ML for detection/classification, sophisticated EW solutions for jamming/spoofing/neutralization, and exploration of diverse effectors (kinetic, directed energy, cyber). The emergence of modular systems like Hellhound and the proven effectiveness of systems like the Iranian 358 missile underscore the rapid evolution of both C-UAS solutions and the threats they face. International cooperation and localized production are increasing. Establishing effective legal and regulatory frameworks remains an ongoing challenge.

Investor Insights: The C-UAS market continues its rapid expansion, offering opportunities across the kill chain (detect, track, identify, defeat). Companies strong in AI/ML (e.g., Palantir [NASDAQ: PLTR], Anduril via partnerships), EW (e.g., ELT Group), sensor fusion, and specialized interceptors (e.g., Raytheon’s – [NYSE:RTX] Coyote) are likely beneficiaries. Handheld and mobile systems (e.g., DZYNE, M-LIDS platforms) are in demand. Modular systems like Hellhound offer potential. The success of systems like the 358 missile highlights the market for capable, potentially lower-cost interceptors. International partnerships and FMS deals indicate a growing global market.

IV. European Land Systems Modernization

Modernization efforts focus on both upgrading existing platforms and developing next-generation capabilities. The UK’s Challenger 3 program is converting 148 Challenger 2s, with 4 prototypes delivered and 4 in build; trials are ongoing, focusing on the new Rheinmetall 120mm smoothbore gun and enhanced ammunition, aiming for IOC in 2027 and FOC by 2030. The program faces criticism for the limited number of tanks being upgraded and past delays. Germany’s Leopard 2A8 is seeing wider interest, with the Netherlands acquiring 46 tanks to form a new battalion based in Germany. Germany is also in talks with the Czech Republic, Lithuania, and Sweden for joint procurement under a framework agreement potentially covering over 100 tanks. The 2A8 features Trophy APS and other survivability/digital upgrades.

France’s Leclerc XLR upgrade continues, with 200 tanks ordered (34 delivered by end of 2024). The upgrade integrates the tank into the SCORPION network and adds protection, but the key PASEO digital sights with AI won’t arrive until 2028. The UK’s Ajax program reached the 100th vehicle milestone, though FOC remains delayed until 2028-2029 due to past noise/vibration issues. The CV-90 IFV saw continued success: Denmark ordered 115 new vehicles, joint procurement of hundreds of vehicles by the Nordic countries, and an MLU for the existing fleet, while the Netherlands invested €400M+ for production destined for Ukraine, including partial manufacturing in the Netherlands. Future European tank development fragmented further with the launch of the EDF-funded FMBTech project (Thales coordinating 26 partners) running parallel to the MARTE project (KNDS/Rheinmetall coordinating 47 partners) underway for the second year.

Assessment: European land modernization shows divergence. Upgrades to existing MBTs (Challenger 3, Leclerc XLR) and procurement of the latest Leopard 2 variant (2A8) are progressing, enhancing capabilities and NATO interoperability. Proven IFV platforms like the CV-90 thrive, benefiting from upgrades, new orders, and innovative multinational production models supporting Ukraine. However, ambitious next-generation programs face hurdles. Ajax’s recovery is slow, highlighting program management challenges. The fragmentation of the future European tank efforts (MGCS, MARTE, launch of FMBTech) suggests a lack of strategic cohesion, potentially delaying a common European capability despite EDF R&D funding.

Investor Insights: BAE Systems Hägglunds [art of BAE Systems, LON: BAES] benefits significantly from CV-90’s success (new orders, upgrades, Ukraine support). The Dutch production model for Ukraine could signal new collaborative industrial approaches. General Dynamics UK [part of General Dynamics, NYSE: GD] sees incremental progress on Ajax, but program risks remain. KNDS (including former KMW) and Rheinmetall [FWB: RHM] are central to Leopard 2A8 production and upgrades, as well as the Challenger 3 program (via RBSL) and the uncertain future tank landscape (MGCS, MARTE, potential German-led project). KNDS France leads the Leclerc XLR upgrade. Thales [EPA: TCFP] coordinates the FMBTech R&D project.

V. Other Significant DefenseTech News

Rocket Lab secured major contracts supporting US/UK hypersonic programs. Space activities included concerns over a Russian satellite event, a German-American intel satellite partnership (OHB/Lockheed Martin), SpaceX’s continued involvement (Golden Dome, launches), and Germany planning a Starlink alternative. Significant defense spending increases were announced by Spain ($12B plan) and Estonia (to 5.4% GDP), alongside continued large aid packages for Ukraine from Norway ($7.8B) and Spain (€1B). Major industry moves included Boeing selling digital aviation assets ($10.55B) 1 and facing challenges with fixed-price contracts, Lockheed Martin integrating NGAD tech into the F-35, Italy ordering AeroVironment JUMP 20 UAS ($46.6M), Gecko Robotics/L3Harris partnering on maintenance drones, Netherlands selecting Oshkosh JLTV, and Otokar forming a JV in Romania for Cobra II production.

Assessment: The broader defense sector shows high activity driven by geopolitical tensions. Hypersonics and space remain key investment areas, with increasing reliance on commercial partners and growing concerns about space weaponization. European defense spending is rising significantly, driven by NATO targets and the war in Ukraine. Major industry players are making strategic portfolio adjustments (Boeing divestment, Lockheed F-35 enhancement) while securing numerous international contracts, reflecting a dynamic global market.

Investor Insights: Hypersonics R&D offers opportunities for specialized firms like Rocket Lab [NASDAQ: RKLB]. The space domain sees investment in ISR (OHB/Lockheed) [FWB: OHB] and constellations (SpaceX), but also faces geopolitical risks. Increased European defense budgets benefit many suppliers across land, sea, and air domains. UAS procurement continues strongly (AeroVironment [NASDAQ: AVAV]). Strategic moves by primes like Boeing [NYSE: BA] and Lockheed Martin [NYSE: LMT] signal portfolio optimization. Maintenance/sustainment tech (Gecko/L3Harris) [NYSE: LHX] and tactical vehicles (Oshkosh [NYSE: OSK], Otokar [part of Koç Holding, IST: KCHOL]) remain active markets.

Analyst Outlook

The week highlighted a drive for high-end systems (LTAMDS, Golden Dome) alongside struggles to counter low-cost threats cost-effectively, stressing the active vs. passive defense debate. The seabed emerged as a critical, contested domain requiring new UUV/AUV tech and doctrines, with autonomy mastery being key but proliferation a risk. C-UAS remains hyper-dynamic, driven by AI/EW innovation and urgent demand, but facing increasingly capable threats like the Iranian 358 missile. European land systems show mixed progress: upgrades and procurements of current-generation MBTs (Challenger 3, Leopard 2A8, Leclerc XLR) advance alongside successful IFV programs like CV-90, while Ajax recovers slowly and future tank programs fragment despite EDF funding. Overall activity is high, fueled by geopolitical tensions, leading to budget hikes, rapid tech development, and strong industry response, though strategic challenges in resource allocation and collaboration persist.

Assessment: Key tensions persist between investing in exquisite platforms versus affordable mass/resilience. Mastering new domains (seabed, C-UAS) requires balancing technological advancement with managing proliferation and counter-capability risks. European defense collaboration shows promise in specific areas (Ukraine support via CV-90) but struggles at the strategic level (MGCS). The defense industrial base responds dynamically but faces challenges in scaling production and aligning investments with evolving threats and economic realities.

Investor Insights: Continued growth is expected in AMD, UUV/AUV, C-UAS, and space domains. Balancing investments between high-end systems and cost-effective solutions presents opportunities for innovative companies. Autonomy and AI are critical enabling technologies across domains. European budget increases offer broad opportunities, but program fragmentation (e.g., future tanks) creates uncertainty for specific long-term projects. Companies demonstrating agile production, strong supply chains, and effective international partnerships will likely outperform. Key MBT players include KNDS, Rheinmetall [FWB: RHM], and BAE Systems via RBSL [LON: BAES].

Carrier Integration Challenges

Carrier Integration Challenges

Rocket Systems – Meeting Surging Demand

Rocket Systems – Meeting Surging Demand Loitering Munitions: Enhancing Precision Strike

Loitering Munitions: Enhancing Precision Strike Mission Control, AI & Autonomy

Mission Control, AI & Autonomy NATO Modernizes Battle Command with AI

NATO Modernizes Battle Command with AI Fighter Aircraft Market Update

Fighter Aircraft Market Update Autonomy Takes to the Seas

Autonomy Takes to the Seas

US Defense Acquisition & Export Reforms Gain Momentum

US Defense Acquisition & Export Reforms Gain Momentum “Golden Dome for America” Initiative Takes Shape

“Golden Dome for America” Initiative Takes Shape Trade Wars & Sanctions Squeeze Critical Mineral Supply Chains

Trade Wars & Sanctions Squeeze Critical Mineral Supply Chains Pentagon Overhauls IT Strategy, Cuts $5.1B in Consulting Contracts

Pentagon Overhauls IT Strategy, Cuts $5.1B in Consulting Contracts Air Defense Demand Continues to Surge Globally

Air Defense Demand Continues to Surge Globally Competition Heats Up for Greek Defense Modernization

Competition Heats Up for Greek Defense Modernization Europe Explores Independent Long-Range Strike Capabilities

Europe Explores Independent Long-Range Strike Capabilities Artillery Production Ramps Up Amidst Growing Demand

Artillery Production Ramps Up Amidst Growing Demand