The Boeing Company (NYSE: BA) was hardest hit by the planned cuts recommended by Defense Secretary Robert Gates announced yesterday. If these cuts are approved, Boeing will be affected by the shutdown of F-22, and C-17 production. The scale-down of Ground Based Interceptor fielding, termination of the Manned Ground Vehicle component of the FCS program, and Combat Search and Rescue (CSAR) program mean serious blows for Boeing. The company will also lose potential business due to major program cancellations including the Transformational Satellite (TSAT) and Next Generation Bomber.

One of the company’s flagships, the Army’s Future Combat Systems, for which Boeing shares Lead Systems Integrator (LSI) role with Science Applications International Corporation (SAIC, NYSE: SAI), is at risk after Secretary Gates recommended terminating the program’s Manned Ground Vehicle component, representing over 50 percent of the program’s cost. Starting over on designing and bidding for those vehicles will directly affect Boeing and its subcontractors, primarily General Dynamics Land Systems and BAE Systems.

While Boeing could suffer the loss of funding related to these vehicles and associated systems, even more critical is Gates’ call to re-launch an Army vehicle modernization program, with a new contractor bidding process, that could bypass the FCS program entirely. So far Boeing and SAIC managed all acquisitions in the program almost as if they were a government-procurement agency. That setup has been criticized severely as a license to funnel money from government to industry. Gates said he is “troubled by the terms of the current contract, particularly its very unattractive fee structure.” In fact, the government plans to hire 13,000 new civil servants in fiscal year 2010 to replace outside contractors. Within five years government employees, replacing contractors could increase to 30,000, Gates said. This could put an end to the LSI role which earned the biggest defense industries a nice and steady income in recent years.

Boeing will also suffer loss of potential business associated with the shutdown of additional F-22 Raptor production. The Air Force was hoping to buy 20 Raptors in FY 2010 and 40 more in the following years. While the aircraft prime contractor Lockheed Martin could offset the F-22 shutdown, by scaling up of the F-35 program, Boeing will have to absorb the loss. Boeing builds the F-22’s wings and aft fuselage for the F-22 fighter but has no role at all in the F-35. Boeing will also bear the consequences of the final shutdown of the C-17 production at Long Beach California, affecting about 5,000 employees. Another Boeing production program to be suspended is the delivery of ground based missile interceptors, originally destined for a third base in Alaska

No doubt, Secretary Gates’ recommendations regarding the C-17 and F-22 programs are expected to draw intensive opposition. Both programs enjoy strong support by the Senate and Congress.

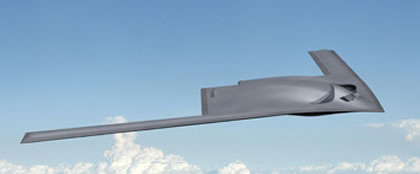

The prospects for new business which Boeing could regain are quite limited; Gates also recommended terminating several major programs for which Boeing has been competing. These include the $26 billion Transformational Satellite (TSAT) constellation of communications-satellites, and a $15 billion combat search-and-rescue helicopter (CSAR-X). Preliminary development of a future long-range Air Force bomber for which Boeing and Lockheed Martin teamed-up, will also be terminated.

A potential bright spot for Boeing is the prospect of winning the Air Force’s KC-X future tanker program; the Pentagon remains committed to restarting the competition this summer. The current budget also maintains funding for 31F/A-18E/F Super Hornets for the US Navy.

General Dynamics (NYSE: GD) will suffer on two fronts – the planned cancellation of the Army’s Manned Ground Vehicle, means loss of research and development contacts for its Land Systems (GDLS) in the immediate term and loss of potential orders for future production, originally expected by the beginning of the next decade. The long term forecast of the company’s shipyards at Bath is also troubled as the future of the future DDG-1000 destroyer is unclear.

The cancellation of FCS MGV is bad news for BAE Systems too (UK: BA). While the company is well positioned to gain from M-ATV and JLTV programs in the near future, production of vehicles for the FCS program was a major element in its plans for the next decade. However, both GDLS and BAE Systems should be well positioned to win future Army orders, as soon as the Pentagon completes its reevaluation and plots its future combat vehicle strategy. Finmeccanica, another international group that scored a major win with the U.S. presidential helicopter will undoubtedly suffer from the cuts.

While termination of future programs such as the Next Generation Bomber (above) or F-22 Raptor (bleow) will have negative infleunce on Boeing, Lockheed Martin, the prime contractor of the F-22 and JSF will be able to shift focus between the two programs, to balance negative effect on work force and expenses. Photo above: Boeing. Below: US Air Force.

Lockheed Martin: F-35 Gain could Offset Raptor Loss

Compared to Boeing, other defense contractors will suffer less from the proposed cuts. Despite the potential loss of the F-22 Raptor and presidential helicopter programs, Lockheed Martin (NYSE: LMT) should be less affected by the cuts. The VH-71 presidential helicopter program which called for Lockheed Martin to deliver a US built version of the AgustaWestland EH-101 helicopter has been troubled for sometime.

Regarding the Raptor, the Pentagon is hopeful that the adverse effects of the early shutdown of the F-22 production after delivering 187 aircraft could be compensated by expediting F-35 productions. Lockheed Martin is the prime contractor for both programs. The company will gain more business through new orders for Littoral Combat Ships, (LCS) and from an increase in the THAAD program, upgrades, planned for the AEGIS cruisers and continued support for Patriot PAC-3. The company can also expect orders for two additional Advanced Extremely High Frequency (EHF) satellites, to be used as an alternative to the cancelled Transformational Satellite System (TSAT).

The impact on other U.S. defense contractors such as Northrop Grumman(NYSE: NOC) is yet unclear. The company is expected to benefit from the new program, with the Ingalls shipyards expected to shift from the troubled DDG-1000 program to building more earlier-version DDG-51 destroyers. The company is also providing subsystems for the Advanced EHF satellites. Cancellation of the Air Force’s plans to develop and build a new long-range bomber to replace the B-2 by 2018, could have an effect on the company’s research and development activities, but is not expected to have substantial financial effect, as these costs should be compensated by more work related to the F-35 program. Finally, their prospects to win the KC-X program this summer are still realistic. However, battered by the recent blows, Boeing is expected to fight with all it has to win this ‘winner takes all’ competition.

Other companies expected to gain from the shift in the Pentagon’s focus include Raytheon (NYSE: RTN), L3 Communications (NYSE:LLL) and UAV developer General Atoics.

The newest (and only) prototype of the Manned Ground Vehicle family of vehicles that have been completed so far is the Non Line Of Sight – Canon (NLOS-C), the automated self-propelled artillery system designed to support the future brigade combat team. The remaining seven MGV types have years to reach the current maturity level of the NLOS-C. Photo US Army