Market Opportunities and Entry Strategies, Analyses and Forecasts to 2016

Australian defense is considered one of the world’s growth markets, even in the recent tough years. In 2009, the Australian government launched a new military modernization plan to upgrade its forces in order to counteract the threat posed by rising global terrorism, changing political dynamics in the Asia-Pacific region and the rising number of peacekeeping operations undertaken by Australian forces. With the exception of an anomaly in 2010, defense expenditure as a percentage of Australia’s gross domestic product (GDP) is expected rise consistently through 2016. The total spending on military in the period 2011-2016 is expected to reach $138.7 billion.

In the years after, this rate is expected to be reduced again, to cover increased sustainment costs.

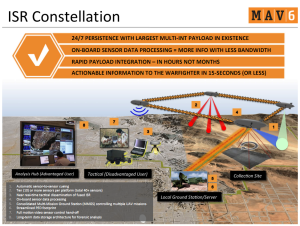

Over the forecast period, the key market opportunities in the defense industry are expected to emerge in categories such as defense information technology, unmanned aerial vehicles (UAVs), helicopters, upgraded vehicles, armory, submarine rescue vehicles, sonar systems, troop protection equipment, patrolling ships, monitoring and security equipment.

Australia imports the majority of its arms, including its aircraft and missile systems, largely from the US, Germany, Israel, Spain and France. However, while the country has been successful in its manufacture and export of military ships, the government is now actively engaged in improving the capability of its domestic defense industry through the Skilling Australian Defense Industry (SADI) program. The government is also focused on encouraging foreign OEMs to outsource manufacturing to gain the neccessary technology to modernize its military. Therefore, Australia’s imports of advanced defense systems from foreign companies are expected to increase during the forecast period (2011-2016).

Rather than imposing offsets on military procurement, Australia instead protects the development of its domestic industry through its Australian Industry Capability (AIC) plan, by asking the Defense Materiel Organization (DMO) to assign and monitor a series of activities for investing foreign OEMs to complete. Furthermore, contract preference is given to the bidder that can provide maximum opportunity for the domestic defense industry as specified in the AIC plan.

The preferred entry route for most foreign OEMs keen to enter the Australian defense market has been to establish a subsidiary in the country or acquire a domestic firm. However, increasingly more foreign OEMs are entering the market by sub-contracting business to the domestic industry or engaging the domestic industry in the global supply chain by way of direct foreign investment. In recognition, the Ministry of Defense has launched a scheme for rewarding defense suppliers that maintain a successful relationship with the Australian Defense Organization.

This 156 page report provides a top level overview of the Australian defense industry, offering insights into market opportunities and entry strategies adopted by foreign OEMs to gain a market share in the Australian defense market. In particular, it offers in-depth analysis of defense market size from 2005 through 2010 and forecasts till 2016 and provides an insight into the Australian defense market and industry with current, historic and forecast market values.

Companies covered in this report: Raytheon Australia, Boeing Defense Australia, Saab Systems Australia, General Dynamics Land Systems Australia, Lockheed Martin Australia, Navantia, Tenix Defense, Australian Aerospace, Serco Sodexho Defense Services, Thales Australia, Australian Submarine Corporation

Report publication date: October 7, 2011

To order the report please contact [email protected] and ask for DF0053MR – SP.pdf

Get the Report

Get More Info