The latest report on international arm’s trade published by the Stockholm International Peace Research Institute (SIPRI) places the People’s Republic of China (PRC) in fifth place among the world’s top exporters of weapons. SIPRI’s Trends in International Arm’s Transfers report places China in the fifth spot for the first time since the Institute’s 1986-1990 reporting period. With China’s ascension to the fifth spot, the United Kingdom now drops to sixth place for the first time since 1950, the year SIPRI published its first report.

The latest report on international arm’s trade published by the Stockholm International Peace Research Institute (SIPRI) places the People’s Republic of China (PRC) in fifth place among the world’s top exporters of weapons. SIPRI’s Trends in International Arm’s Transfers report places China in the fifth spot for the first time since the Institute’s 1986-1990 reporting period. With China’s ascension to the fifth spot, the United Kingdom now drops to sixth place for the first time since 1950, the year SIPRI published its first report.

China is estimated to account for 5 percent of the world’s arm’s exports with the United States still commanding a strong lead with 30 percent of the international export total. Pakistan, listed in the report as the world’s third largest arm’s importer, is China’s most important customer.

As an independent international institute, SIPRI is renowned for the validity of its research data and analysis. The institute’s data is based on the volume of trade as reflected in arm’s deliveries and does not represent the monetary value of such trades.

SIPRI manages a comprehensive database of arm’s transfers that details imports and exports dating back to the 1950s. Information contained in the database is averaged over five-year periods to present a trend that accounts for variations in sales and purchase volumes from year to year.

Between 2008 and 2012, China’s weapon’s exports jumped 162 percent in comparison to the last five-year period covering the years of 2003 to 2007. This increase reflects a rise in China’s share of the international total from 2 percent to five percent.

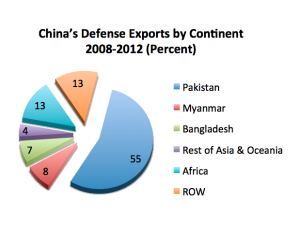

Pakistan was the recipient of 55 percent of China’s weapon’s exports during the period covered by this report. This trend is very likely to continue for some years to come considering the large volume of outstanding Pakistani orders as yet to be filled and proposed future orders. Pakistan is expected to initiate additional future orders for submarines, frigates, and combat aircraft.

China has been pursuing an aggressive campaign to increase arm’s exports and these efforts are obviously paying dividends. Myanmar, although undergoing critical reforms supported by the United States, accounted for 8 percent of China’s weapon’s exports. Bangladesh has been right on Myanmar’s heels claiming 7 percent of China’s arm’s shipments. Other key nations including Morocco, Algeria, and Venezuela have also been solid Chinese customers.

SIPRI’s report also identifies China as being the world’s second place importer of arms with 6 percent of the international total. India is the world’s number one importer with 12 percent of the global total. The report indicates that the Asia-Pacific region has become the world’s largest importer of weapons with India, China, Pakistan, South Korea, and Singapore claiming title to the top five spots. Now, the region accounts for 47 percent of the global total of conventional arm’s imports.

As the world’s second-leading economy, China has been able to increase defense spending by double digits throughout most of the past two decades. This increased infusion of funding has financed the efforts of domestic contractors in developing high-quality weapons that are beginning to rival the best produced by Russia and the United States. As China’s defense industry grows and matures, its reliance on foreign imports will likely begin to decline significantly in future years.

With numerous restrictions complicating China’s access to arm’s imports; domestic contractors have become increasingly important in Beijing’s efforts to build a modern military force capable of supporting its future political and economic interests on a global stage.

The United States remains the world’s number one arm’s exporter with a 30 percent share of the global market followed closely by Russia with a 26 percent share. Germany and France are a distant third and fourth with a 7 percent and 6 percent share respectively.

The world has witnessed a sharp increase in arm’s trading since 2003, growing almost 50 percent to an international total of more than $1.4 trillion. Despite the economic woes weighing down many nations, the market for conventional weapons is likely to remain strong as Asian-Pacific nations race to keep pace with a much improved and growing Chinese military presence, a presence many nations fear may eventually become too great to challenge.

Read the report at SIPRI website